Disclaimer:All information in this newsletter is not intended for investment decisions / purposes. Mnt Goat is not a financial analyst, planner, banker, attorney or associated in any role with giving out professional investment advice.

ABOUT THE NEWSLETTER:

February 19, 2026 Mnt Goat News Brief

Guten Tag everyone:

WOW this RV saga continues with the election cycle. The showdown not just with Iraq but also with Iran is close at hand.

GIVE A GIFT TO MNT GOAT

I decided to allow everyone to give a Free-will GIFT to Mnt Goat on PayPal if you so desire. Here is the link below. Please show your appreciation for all the hard work I do.

I recommend $15-$20 dollars a month or whatever you can afford. Do you realize I write up to eight (8) Newsletters every month. This is like a second job to me. The only way I know that people are reading and appreciating all the FACTUAL news I bring is through their appreciation. If I do not receive equal appreciation for all the hard work I do, I will simply end the Newsletter and save myself endless hours at the computer. You do want to get paid for your job, don’t you? What makes my job any different? Tell me….. I am tired of this RV saga just as you are. We are now down to addressing the Iranian militia in Iraq. This is a very good thing and had to happen sooner or later. The RV will not happen as long as Iraq is a proxy state of Iran.

Let’s all try to chip in!

____________________________________

2 Corinthians 9:7

It is written we are all called to be cheerful givers to those in need. “Each of you should give what you have decided in your heart to give, not reluctantly or under compulsion, for God loves a cheerful giver.”

More news….

THE NEXT 10 DAYS?

US President Donald Trump stated on February 19 that he will likely decide on whether the United States will strike Iran within the next ten days. Trump warned Iran to accept a deal and threatened unspecified consequences if it does not. One US official told Axios on February 19 that Iran has until the end of February 2026 to present the Trump administration with substantive steps to address US concerns regarding its nuclear program, which is consistent with Trump’s ten-day deadline.

A second US official voiced pessimism that the Geneva talks on February 17 would result in a deal. ISW-CTP continues to assess that Iran is unlikely to meet US demands of zero-enrichment, limiting its ballistic missile program, or ceasing support for its proxies and partners in the region. (Including Iraq) The US statements come amid a large number of US military deployments to the region, including the upcoming arrival of the USS Gerald R. Ford carrier strike group.

More news….

THE US MILITARY INFORMS TRUMP OF ITS READINESS TO STRIKE IRAN “AS SOON AS POSSIBLE”.

Senior national security officials have informed US President Donald Trump that the US military is ready to carry out possible strikes against Iran as early as Saturday, although the timeframe for any military action could extend beyond the weekend, according to CBS News on Thursday, citing sources familiar with the consultations.

Officials confirmed that Trump has not yet made a final decision on carrying out the strike, at a time when discussions within the White House were described as ongoing and changing, with a careful assessment of the risks of escalation and the political and military repercussions, whether to act or refrain from doing so.

She added: “It would be very wise for Iran to reach an agreement with President Trump and his administration.” The United States had already deployed the USS Abraham Lincoln carrier strike group to the region, while the USS Gerald Ford was en route to the Middle East, and maritime tracking data showed it was off the coast of West Africa as of Wednesday.

More news….

THE US 7 DEMANDS ON IRANIAN INFLUENCE IN BAGHDAD

The letter places heavy emphasis on reducing Iranian influence in Baghdad’s political and security affairs amid ongoing US-Iran tensions and Iraq’s prolonged government formation process following the November 2025 elections.

The letter underscores how Iraq’s government formation has become a key arena in the larger US-Iran contest for regional dominance

The United States delivered a pointed diplomatic message to Iraqi leaders, outlining seven specific demands for the selection and performance of the country’s next prime minister.

The letter, reported by Al-Monitor on Thursday, places heavy emphasis on reducing Iranian influence in Baghdad’s political and security affairs amid ongoing US-Iran tensions and Iraq’s prolonged government formation process following the November 2025 elections.

The seven demands:

According to sources familiar with the correspondence, the US letter specifies the following conditions for the incoming prime minister and the government they lead:

- Elect a prime minister who prioritizes Iraqi national interests above external alignments, particularly those tied to Tehran.

- Institutionalize and bring the Popular Mobilization Units (PMU) — a coalition of mostly Shia militias, many backed by Iran — fully under state control, limiting their independent operations.

- Reduce corruption and combat money laundering, with a focus on disrupting illicit financial networks that benefit Iranian-aligned groups.

- Limit or exclude Iranian-backed militias from key positions in the new cabinet and security apparatus.

- Strengthen Iraq’s sovereignty by curbing foreign interference, especially from Iran, in domestic governance and decision-making.

- Enhance cooperation with the United States on security, counterterrorism, and economic matters as a partner rather than a conduit for regional rivals.

- Implement reforms to promote inclusive governance, economic diversification away from oil dependency, and accountability to prevent sectarian divisions.

More news….

“WE CANCELLED OUR MEETING YESTERDAY BECAUSE IT WAS POINTLESS DUE TO MALIKI’S INSISTENCE ON RUNNING FOR PRIME MINISTER.”

Al Jazeera quoted a leader in the coordination framework as saying: “We cancelled our meeting yesterday because it was pointless due to Maliki’s insistence on running for prime minister.”

Al Jazeera quoted a leader in the Coordination Framework as saying that the Framework’s forces cancelled their meeting scheduled for yesterday “because it was pointless,” noting Nouri al-Maliki’s insistence on running for the premiership.

The leader added, according to the channel, that “everyone is convinced that al-Maliki’s nomination will not pass,” in light of what he described as “the seriousness of the American sanctions,” considering that these factors make the chances of agreeing on his nomination limited at the present stage.

(So this article also tells us Maliki lied to the press in a recent comment that he will volunteer to give up his nomination if the Coordination Framework decides it. Now we here the Coordination Framework cancelled their meeting to decide because Maliki refuses to concede his nomination. Yes, this Maliki is dangerous and will do anything to get in power. How did he ever even rise to this point in the elections? Oh…. we know it is through lying and deception. )

More news….

EXCEPT FOR HAMOUDI, THE COORDINATING FRAMEWORK WITHDRAWS ITS SUPPORT FROM MALIKI.

See the full article at this link

Iraqi sources reported on Thursday that some members of the Coordination Framework and Shiite blocs withdrew their support for Nouri al-Maliki’s candidacy, while only Humam Hamoudi, head of the “Abshir Ya Iraq ” bloc, which holds 4 seats in the Iraqi parliament, continues to support him .”

The sources added that “the deadline given by the US Chargé d’Affaires, Joshua Harris, to the political leaders within the coordination framework ends today .”

She noted that “a meeting of the coordination framework was scheduled for last Monday, but it was postponed at the request of al-Maliki due to the expiration of the deadline, and it was postponed to Thursday.”

STATUS OF THE RV

I hope everyone is ready for a pivotal period in this Iraqi election saga. It has to come to an end eventually…. better sooner than later!

I guess many of my blog followers must be bored with hearing about the Maliki drama in the elections in Iraq? Remember that even if the news is not to your liking, it is HONEST and TRUTHFUL news. I can not make up news just to make you happy. I refuse to do it. This brings me to the idea that it appears people don’t ‘appreciate’ bad news only good news? Remember too that my level of research, calls to Iraq and publishing the Newsletter twice a week is the same effort regardless if the news is good or bad. I can only report on the news as it stands, get it? I don’t listen to these three letter agencies and bankers. Yes, I get the same feedback from them as others reporting on intel of the RV, but the difference is I have common sense and not stupidity guiding me. I do not just repeat what the tell me and then walk away. I am not selling any products with kick-backs from sponsors, I do not get subscriber fees of any kind. I only rely on generosity and those who want the TRUTH.

Is it unfortunate that this RV saga has gone on too long already and I have to ask for help for my efforts. So, having said this, let’s consider all my efforts, that is the important point.

____________________________________

Okay, so what is today’s news? Is there anything amazing to report?

Hang on to your seats because the next couple weeks are going to be explosive, but right now we are in waiting mode until these Iranian issues are resolved.

The main topic is of course watching for the inevitable US and Israeli bombing of Iran’s strategic sites. Will the US put boots on the ground? There are many US marines on tactical landing ships along with the naval fleets now stationed offshore. I personally don’t believe there is currently any plan for a ground invasion.

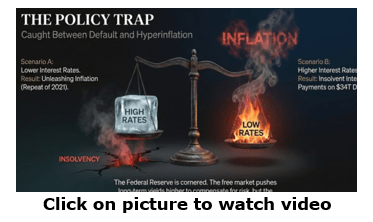

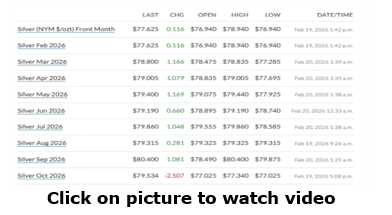

As we know the Iraqi parliament has taken a break until these issues are settled. The Iraqi speaker of parliament has put all sessions on hold. Yes, I have spoken to my CBI contact on Wednesday as usual. She assures me that unless the Iranian influence in Iraq is addressed, along with tensions from Tehran, there will not be a reinstatement. The US will not sign off and will hold it up. She said we would hear all kinds of comments about the independence of the CBI and how they can adjust the rate anytime they want. Yes this may be true but what rate are you talking about? Some don’t even realize there are two types of rates, one is the program rate and they other the FOREX rate. We all should know the difference by now. We must use our own heads to decide for ourselves, what does this mean?

It means that the ‘program’ rate tied to the de facto peg can be changed upwards or downwards by the CBI any time. This does not mean allowing the dinar back on FOREX, get it? This is still in the currency auction mode as they used while under UN sanctions. When the dinar goes back to FOREX it will be re-pegged and off the sole peg to the dollar and the program rate will go away. The newer lower denominations would have to first be rolled out. We are talking apples and oranges when we talk about these two rate types. Remember also they can NEVER coincide at the same time. The dinar can only have one ‘official’ rate. There is no such thing as an in-country rate and then a FOREX rate at the same time. Get it? When the dinar does go back to FOREX , the in-country rate (program rate) will change to the FOREX rate.

________________________________

Let’s get to the news for today.

😊 In the article titled “DONALD TRUMP IS FORCING A RESET IN IRAQI POLITICS” On Jan. 27, Donald Trump issued an ultimatum to Baghdad. Noting that Iraqi lawmakers were considering “reinstalling” Nouri al-Maliki as prime minister, Trump delivered an uncompromising verdict: “Because of his insane policies and ideologies, if elected, the United States of America will no longer help Iraq.” The article is an amazing FACT-filled article worthy of a read all the way through to the end. 😊

Thanks to intense behind-the-scenes deal-making, Maliki outmaneuvered current Prime Minister Mohammed Shia al-Sudani (whose party had gained the largest share of the vote) and managed to secure the nomination.

This triumph seemed even more improbable given Maliki’s deep unpopularity and his divisive politics

However, since Jan27th lots has developed. Nori al-Maliki has come out with statements defying the US and president Trump. Also news of the past policies of Maliki have surfaced from his time as prime minister (2006-2014). We also must not forget the state that Iran is now in as the regime will soon fall. Today is now 3 weeks since Trumps ultimatum to Baghdad. Actually his envoy Mark Savaya had also delivered the warning weeks prior even. The Coordination Framework, currently the largest block is still standing firm with Maliki as their nominee for prime minister. In recent past articles we read of three ways to block Maliki but there is a fourth way that has evolved and may be the end to Maliki and possibly even the Coordination Framework as the largest block.

😊 If we read article titled “ASA’IB AHL AL-HAQ: 7 PARTIES WITHIN THE FRAMEWORK ARE DEMANDING THE WITHDRAWAL OF AL-MALIKI’S NOMINATION”we read so far seven (7) out of twelve (12) may pull out of the Coordination Framework. Work is now underway in putting together their own coalition around the Coordination Framework making them the new largest block. I do not know what they will call themselves and if this will really happen. But my contact in the CBI tells me this is now on the table if the Coordination Framework does not back down with Maliki. I quote from the article “A member of the political bureau of the Asaib movement stated that there are 6 parties within the coordination framework who oppose the nomination of Nouri al-Maliki for the premiership, expecting that a seventh Shiite party will join the front of those demanding the withdrawal of the nomination tonight (Wednesday). Al-Shihani said in a televised interview followed by Al-Sa’a Network: “I contacted 3 of the leaders of the framework who voted in favor of Al-Maliki at the framework meeting, and I found that they were very concerned about the recent threats, and they said frankly that they have a new opinion regarding Al-Maliki’s nomination .”

😊To back up this notion of a new largest block, we can go article titled “EXPERT: IGNORING US THREATS COULD PLUNGE IRAQ INTO COMPLEX CRISES”. I will quote from the article – “Strategic affairs expert Hussein Al-Asaad confirmed on Saturday (February 14, 2026) that the United States’ threats to impose sanctions on Iraq if any new government is formed that does not have its approval must be taken very seriously and carefully considered, given their potential repercussions on the political, economic and financial stability of the country.”

He added that “the formation of the government must be based on a broad national consensus and a clear government program that reassures the international community about Iraq’s commitments, while at the same time preserving its independent decision-making. Ignoring or downplaying American warnings may open the door to complex crises, the price of which will be paid primarily by the citizens.”

😊 Then we can also tie into the news in article titled “WITHDRAWING AL-MALIKI’S NOMINATION”… TONIGHT, REQUEST NUMBER 7 WILL APPEAR ON THE ASA’IB ACCOUNT”

Amid the Shiite framework’s inability to hold a meeting despite successive attempts since Sunday, a member of the Asa’ib Ahl al-Haq movement’s political bureau said that the American threat, which began to indicate the punishment of Iraqi ministries such as Defense and Foreign Affairs, caused positions to change rapidly, to the point that the parties opposing Nouri al-Maliki’s nomination for the premiership became 6 members of the coordinating framework, after it was only 3. Moreover, Hussein al-Shehani, who was speaking in a dialogue with journalist Ali Imad, which was followed by 964 Network, expects a seventh Shiite party to join the front demanding the withdrawal of the (peanut-head) nomination tonight.

They say, “God help the framework” if it changes its choices. There will be voices of support from the Brotherhood within the State of Law coalition, especially those close to Maliki. Today we have moved beyond the issue of being influenced by the tweet. Again, they are basing their decision for Maliki on ideology and not common sense or past performance. This radical Islamic ideology is ruining the middle east.

The Kurds and Sunnis will not come to parliament to vote for a president who would appoint Mr. Maliki as prime minister. This is yet another roadblock.

This last part of the article also tells us the state of mind for many of these members of the Coordination Framework. I will quote from the article – “Why do we condemn the Sunnis and Kurds today for being influenced by the American decision, and not criticize the Shiites who are sometimes influenced and “enjoy” the blessing that comes from Iran?” Again, they are basing their decision for Maliki on ideology and not common sense or past performance. This radical Islamic ideology is ruining the middle east.

😊 The US White House also just sent through diplomatic channels (not a tweet) an official letter stating the seven demands concerning Iraq and the Iranian influence. Please see article titled “THE US 7 DEMANDS ON IRANIAN INFLUENCE IN BAGHDAD”. The letter places heavy emphasis on reducing Iranian influence in Baghdad’s political and security affairs amid ongoing US-Iran tensions and Iraq’s prolonged government formation process following the November 2025 elections.

The letter underscores how Iraq’s government formation has become a key arena in the larger US-Iran contest for regional dominance

😊 Then we read there may be relief from the deadlock of this ongoing saga from the Maliki issue in another article titled “ON ONE CONDITION… MALIKI THREATENS TO WITHDRAW, AND AL-SHATRI TOPS THE LIST OF CANDIDATES TO SUCCEED HIM”. As the political deadlock continues to grip Iraq, new information and reports have revealed the conditions set by the leader of the State of Law Coalition, Nouri al-Maliki, in exchange for withdrawing his candidacy for the position of Prime Minister, coinciding with talk of intense international pressure to exclude him from the scene.

In this regard, Mahmoud al-Hayani, a member of the Coordination Framework, told Kurdistan24, “Nouri al-Maliki is prepared to withdraw his candidacy on one condition only: that the leaders of the Coordination Framework unanimously or by majority vote request him to do so.” Al-Hayani emphasized that al-Maliki has no intention of backing down under any external pressure, stressing that the decision remains contingent upon consensus within the Shia political bloc.

On the other hand, media sources reported that a new American message was sent to the leaders of the Coordination Framework last night, in which Washington clearly expressed its opposition to Nouri al-Maliki assuming the premiership again, stressing its categorical rejection of this option.

Maliki presents himself as if he has a choice. The Coordination Framework is boxed in and has no choice but to let Maliki go or they will lose the majority block. We are hearing this is a critical week for this to be ironed out, however I believe this will not happen until the issues with Iran are also settled first by the US one way or the other.

______________________________

Is there any good news?

😊 In the article titled “ADVISOR TO THE PRIME MINISTER: PUBLIC FINANCES FOR 2026 HAVE ENTERED THE PRACTICAL IMPLEMENTATION PHASE.” Attention is focused on revenue indicators and public spending patterns as the clearest measure of economic stability. With the continued flow of oil revenues, the issue of salaries has emerged as a top priority for a large segment of society, and assurances have been given that salaries are secured.

The Prime Minister’s financial advisor, Mazhar Muhammad Salih, stated that “public finances for 2026 have entered the practical implementation phase of the provisions of the amended Federal Financial Management Law No. (6) of 2019, which mandates securing monthly resources of the highest priority to cover mandatory expenditures, primarily employee salaries, pensions, and social welfare allocations, estimated at approximately (8) trillion Iraqi dinars per month.”

These obligations constitute the core of current social spending, necessitating meticulous liquidity management and strict regulation of spending priorities.

If you recall the results of many of the IMF consultation sessions with Iraq the top priority was for Iraq to expand their economy from sole oil revenues as a means of Public Financing, especially the monthly salaries, which we learn today again amount to 8 trillion dinars or almost 8 billion dollars. To me this news today is telling us that Iraq has achieved this goal or is very close to it. How did this occur?

😊 We can also tie into the news in the article titled “NO TURNING BACK ON THE ASYCUDA… THE GOVERNMENT CALLS ON TRADERS TO ACCEPT THE NEW REALITY”to get some answers to what the Prime Minister’s financial advisor, Mazhar Muhammad Salih, has stated that “public finances for 2026 have entered the practical implementation phase in the last article. What do they mean when they say “the 2003 system has ended” ? I think it is clearly explained in this article today. Yes, change is hard but Iraq must move on from the past 22 years since 2003. The system put in place since 2003 is over (referring to the currency auctions and the way trade was conducted) and I think this is the announcement that Salih is making in this article. Let’s take a peek at the highlights of the article as why we think this is the case. Now everything is strictly tracked, monitored and tariffs/customs applied. No more faking imports to get the dollar. Of course these money changers are going to be pissed off. You just took their livelihood away from them. It was also illegal…

I quote pieces from the article – “The Iraqi government called on Sunday (February 15, 2026) for those objecting to the implementation of the ASYCUDA system and customs tariffs to accept the new reality and comply with the law. Speaking on behalf of the government, spokesperson Bassem Al-Awadi explained that this system, which is implemented in more than 100 countries, will be applied in Iraq under international and UN supervision. He added that part of the ASYCUDA implementation is linked to Iraq’s international obligations in the areas of combating money laundering, currency and goods smuggling, and international trade.

The government spokesman stressed that “this system is not targeting a specific class, and the rumors that speak of a lack of liquidity in the Iraqi state and that is why it went towards this system are untrue. All of this is incorrect, because the process of trade, accounting and customs since 2003 was an arbitrary emergency process, and in the end, now this year or next year or after 3 years, everyone knows that these temporary matters must end and we must move towards the right things.”

Note that any movement in the direction away from the sanction mode of the past is a good mode. Iraq is getting normalized. Everyone of such movements brings them nearer to the accession to the WTO and to the Reinstatement.

Now, having said all this good news let me present an article to you of what might happen to the Iraqi economy if the Iranian influence is not squashed in Iraq. Does Iraq really want this to happen with all the progress they have made? Just saying….

Here is the article titled “MORE SEVERE THAN THE 1991 EMBARGO… WHAT IS THE NATURE OF THE AMERICAN SANCTIONS THREATENING IRAQ?” Hoshyar Zebari, a leader in the Kurdistan Democratic Party, stated that the United States has threatened Iraq with sanctions even harsher than those imposed in 1991, including the SOMO company, the Central Bank, and other institutions .Zebari said in a televised interview followed by Al-Sa’a Network, “America has confirmed that it will not deal with any government that includes representatives of some factions listed on the terrorism or sanctions lists of the Treasury Department, and they will not deal with any government, even with ministries occupied by those affiliated with the factions .”

He added that “America has threatened sanctions against SOMO, the Central Bank, and dollar flows, sanctions that are more severe than the 1991 embargo,” noting that “Washington has confirmed that it will not finance any regime or government that violates its sanctions .”

SUMMARY:

Many of us may look at what is happening in Iraq as gloom and doom with this Iranian issues. We sit back and look at maybe 2027 for the RV. Remember that it is only February 2026 and so things in Iraq are known to change suddenly and pivot. Let’s keep looking at the glass as half full and not empty.

Insert pic

We all have known about the Iranian militia for years (since 2014) and knew it would someday come down to a showdown with the US, only we needed the right president to do it. Our prayers are working as God has brought us president Trump to make some commons sense out of this middle east mess and peace with it. But first, unfortunately the enemy must be defeated or there will never be peace. Get it? You can’t pacify terrorists and expect them to disappear and leave you alone. You will still remain on their radar for another day. Europe tried to do this with Hitler in WW2 and did it work? Have we learned anything out of that war?

As a congregation when we sit in our churches and pray for peace or maybe pray alone, do we then leave our intentions behind and go support against what we just prayed for? Or do we seek out peacemakers who can help bring that peace we just prayed for? Or is it all empty just words?

_______________________________

We pray-

A nice prayer from one of my blog followers. Thank You!

“Be still, wait on the Lord, my modern David will slay the so-called giant of Islam. It will fall they are already begging for mercy, but it will not come as they have sinned so greatly with their blasphemy, disregarded all warnings for the Lord and now HIS WRATH WILL CONSUME ALL WHO CURSE THE CHOSEN!!

______________________________

________________________________________

Their words not mine…..No Rumors, No Hype, No Opinions ,,,,,

Just the FACTS!

PRAYING WITH SINCERITY

Many may ask why their prayers are not being answered. Our new Shepard in Rome Pope Leo XIV has given us some direction.

You can purchase a nice pair of Rosary Beads here to pray:

These prophecies are more important now more than ever. They give us the strength, perseverance and hope that a better time is coming and that God’s Hand is at work behind the scenes. If you just take a second even to look around you at these past three election cycles, how can you deny that God is at work? Are you sleeping or what?

It is amazing and there is no other way that these events could have happened the way they turned out. But there is more to come, much, much more, I assure you! Now that God has his biblical David re-elected, we need to pay attention to what He does next.

NOTE: These prophecies just keep getting better and better, giving us HOPE of a brighter future. But the real reason why I listen to them is that we can actually see what God says He will do is taking place right in front of our noses. It is a confirmation to me that God is real and is still with us forever just as in biblical times.

Prophetic Words from prophet: Julie Green

“Many People Will Die“

Go to mark 13:31 for prophecy. Given on Feb 14th.

Not an easy prophecy for Julie to give out or for me even to want to present. It is a sad day for America we even have to go through this. God talks again about a lot of people dying suddenly. We must be getting VERY close to this event as he talked many times already about it already. This is usually how these prophecies work. The ‘Angel Of Death’ is coming .

- A senator and a congressman will die in the same day (I first head this one years ago when God said two will die from the same house. I guess he meant house of representatives. (wouldn’t surprise me if it Mitch O’Connell, Maxine Waters and/or Nancy Pelosi

- A supreme court justice will die

- A former president will die (wouldn’t surprise me if its Joe Biden)

- Many former politicians will die

- Those still attempting to kill God’s David (President Trump) will pay for it with their lives.

- The truth about who the guy in the White House really was who called himself Joe Biden.

- The truth about the 2020 election will come out and the truth behind the acter that was inaugurated and we had to deal with for four years.

- Proof of the work of Obama during the Biden presidency will prove Biden is not who he says he was. The ‘mask’ will be uncovered.

- Video proof of who was really signing everything that supposedly Biden was signing.

- Hidden cameras in the White House will prove what was going on

- Proof will show Obama was running the Biden White House, is not an American citizen and he was groomed to run the ‘New World Order’.

- Etc. etc… WOW! WOW! WOW!

Let’s watch this one closely. Lots of moving pieces. Take these pieces you are going to hear in the news, check them off as this prophecy is being fulfilled.

Prophetic Words from prophet: Andrew Whalen

“Severe Judgement Is Coming For Obama”

Go to the 00:14 mark for prophecy. Given on Jan 29th.

Prophetic Words from prophet: Hank Kunneman

“THE END TO THE ISLAMIC REPUBLIC OF IRAN IS NEAR”

Go to the 00:00 mark for prophecy. Given on Feb 22nd.

“I saw a new Iran”

Prophet Carolyn Dennis:

“IT IS WEALTH TRANSFER TIME!”

There is no time in the history of the planet like what is about to come.

Fr. DON BOSCO EXPOSED THE DARK SECRET BEHIND ISLAM

— And the Truth the World Forgot about the so-called Muslim religion. Fr.Don Bosco, also known as John Bosco, was an Italian Catholic priest and educator, born on August 16, 1815. He founded the Salesian Society in 1859 to help disadvantaged youth, particularly boys, through education and community service. His teachings emphasized lovekindness, and the importance of education for young people, making him a beloved figure in Catholicism and a patron saint of youth. Don Bosco was canonized in 1934.

SUPREME COURT RULING ON TRUMP’S TARIFFS: THE TRUTH

Before some go off half-cocked and make claims that Trump’s financial reset has been stopped, please take some time to listen to the real story of what just happened.

Trump’s tariffs are not stopped and will not be stopped, just so you know. The liberal news media once again strikes to bash Trump and his plans to make America Great Again.

Did the recent supreme court ruling really change anything?

PEOPLE HAVE NO IDEA WHO ILHAN OMAR REALLY IS…

So, let’s get educated today!

UPDATE ON THE ‘SAVE ACT’. WHEN WILL IT COME TO A VOTE IN THE SENATE?

“IRAN IS GEARING UP FOR A DESTRUCTIVE MOVE AGAINST AMERICA…”

We will deal with the Iranian regime now or later. Why give Iran time to rebuild and leave this mess to our children to deal with. Yes, they will have to deal with it. It even gets worst if they should get nuclear weapons. Remember this is an Islamic Terrorist regime that mirrors much like the Nazi regime in WW2 and would not hesitate to use any lethal weapons to stay in control. If we are paying attention we see this very same Islamic terrorist organization coming into our countries with refugees and illegal immigrants. They then become politicians and work against our values and culture. Remember their goal – convert to Islam or die. If we had faced Hitler earlier it never would have gone as far as it did. It is time now to address Iran. Not only could this stop this regime and the suffering in Iran but also the outward aggressive Muslim movement to take over our cities. Remember they don’t care if it takes 20 years or 50 years or even a century. Their goals remains the same and we must squash it now before this gets out of hand or maybe it has already gone too far.

‘PLAYING FOR TIME’: The fatal mistake that could DESTROY the Iranian regime

I don’t think I have to go through again how these effects the RV of the Iraqi dinar, do I?

THINK AGAIN: IT WAS NO COINCIDENCE, BUT AN ORCHESTRATED, DELIBERATE PLOT!

As you should know by now, I present these videos on my blog for you not me. They are to you so you can try to understand what is going on in the world that affects our RV of the Iraqi dinar and a very real possibility of other currencies too. You keep asking for a date for the RV. So, what is holding it up?

So, after years of showing you the chaos by the deep state of what they are doing to our world and their pullback on fixing it, today I want to connect some pieces for you to go further, go deeper in your understanding. They call this demolition of our modern industrial social as voluntary and it was. So, who was running the US since 1977 and why did our past presidents, Congress and the Senate allow this to happen? Why did they give the Council in Foreign Relations (CFR) so much power to literally destroy our countries. Today we learn about the real fight. The real reason why these policies being instituted by the Trump administration, to stop this controlled demolition of our economies.

First, I was hoping everyone had a chance to watch the entire speech by the US secretary of state Marco Rubio in Munich recently to the European leaders. I have left his speech for you. Then there are many analysts who have picked his speech apart but none like what Sudan Kokinda has done for us. She ties it all together in big bold statements and backs it up with FACTS, not conspiracy theories. Is this why we voted for Trump? Is this why they want him gone so bad? Is this the Trump hatred syndrome we witness in many of these democrats? Is this why they are trying to kill him?

About our Iraqi dinar: Yes, these are the same powers in control that need to lose their control and thus we have a chance to see the reinstatement of the Iraqi dinar. Do you think they want us to have all this money? Do you think they want this transfer of Wealth? Do you see the struggle now in the Iraqi elections using the Iranians to squash progress in Iraq. Prime Minister al-Sudani was industrializing Iraq with the fundamental principles of free enterprise with the Development Road Project, etc.. Folks they even finally have an acceptable Oil and Gas Law but they can’t get parliament to take it up for a vote. Do you see the roadblocks?

I sincerely hope that you can elevate your thinking to a new level and expand your thinking thus go one step deeper after watching these presentations today. Please take the time to watch the Rubio speech in Munich and then the Kokinda explanation.

“THE CONTROLLED DISINTEGRATION OF

THE WORLD’S ECONOMY WAS DELIBERATE”!

THIS IS JUST THE BEGINNING: THE EU BREAKUP

The fantasy affair is over. It’s time to realize reality! Let’s watch this all play out since Rubio put all the cards on the table in his Munich speech. Join the US or you are doomed staying with this policy of controlled demolition of your country. As more and more countries take the US up on its offer to help, they will join the US and slip out of the EU. Yes, the controlled demolition of the EU…. lol.. lol.. lol.. 😊 I can hardly wait for it.

EXPOSED DARK MONEY GROUPS IN MINNESOTA

I have created a brand-new “Post RV Workshop” page in the blog. I included my own personal tips on investing post-RV and also organizing and protecting your estate. Here is the LINK. Going forward I will only post new and exciting information and opportunities here on the Latest Newsletter as they come along. Later I will transfer it to the ‘Post RV Workshop’ page in subsequent Newsletters for your future reference.

Just so you know I absolutely DO NOT adhere to high-risk investments where you can lose it all in a flash. Look at it this way – you are going to have all this money. Most of us investors waited decades for this RV to happen and so why would you even think about pissing is all away in some high-risk gamble of an investment. Yes, there are going to be scammers out there but let’s talk about legitimate investment opportunities only. These scammers can suck you dry and there is not a damned thing you can do about it. Go to a legitimate wealth manager associated with your bank. Let the licensed experts advise you. Please, please stay away from idiots like MarkZ, TNT Tony, Bruce on the Big Stupid Call, etc. , etc.

15% GROWTH? TRUMP CONFIRMS MASSIVE STIMULUS — THIS WOULD CHANGE U.S. HISTORY

If the U.S. is to reach up to 15% growth rate the monetary policies would have to drastically change. What would the new policies look like? Is his new Fed chairman going to have the task of dismantling the Fed?

Citizens would need more money in their pockets, in other words, much more of the money than ever seen before will have to flow through the system to get this kind of growth.

The tax system would have to also drastically change. Perhaps the IRS will also be dismantled and newer means of revenue generation will be devised to support the Federal government expenditures.

Periodic stimulus checks to the citizens would have to be paid out.

What will be the driving catalyst? It’s a lofty goal (15%) and so can his administration pull it off?

AN INEVITABLE DE FACTO MERGER BETWEEN THE FEDS AND THE TREASURY

MOST PEOPLE HAVE NO IDEA WHAT’S COMING FOR GOLD & SILVER

7 THINGS YOU NEED TO DO WHEN YOU SUDDENLY GET RICH

DONALD TRUMP IS FORCING A RESET IN IRAQI POLITICS

(An amazing FACT-filled article worthy of a read all the way through to the end. 😊)

On Jan. 27, Donald Trump issued an ultimatum to Baghdad. Noting that Iraqi lawmakers were considering “reinstalling” Nouri al-Maliki as prime minister, Trump delivered an uncompromising verdict: “Because of his insane policies and ideologies, if elected, the United States of America will no longer help Iraq.”

These words were enough to end the prospects of Maliki, who had secured the nomination of the largest parliamentary bloc, the Coordination Framework (CF), to form the next government. This came more than two and a half months after the parliamentary elections on Nov. 11. That spell of political paralysis was not unusual. Under Iraq’s system, elections do not grant the party that wins the highest number of seats the automatic first opportunity to form a government. Instead, this right goes to the largest parliamentary bloc formed after the elections.

Maliki’s State of Law Coalition came in third, with 29 seats. Thanks to intense behind-the-scenes deal-making, Maliki outmaneuvered current Prime Minister Mohammed Shia al-Sudani (whose party had gained the largest share of the vote) and managed to secure the nomination.

This triumph seemed even more improbable given Maliki’s deep unpopularity and his divisive politics. Initially, though, it seemed that none of this would be enough to block his path to the premiership.

Trump’s intervention immediately changed everything. So why was it so effective?

The reality is that the U.S. still has ample leverage over the government in Baghdad. Washington could start by simply closing the account at the U.S. Federal Reserve Bank of New York where Iraqi oil revenues are deposited and protected from the enforcement of numerous compensation judgments stemming from Iraq’s invasion of Kuwait – protection granted under a U.S. presidential order issued in 2003 and renewed annually. Closing this account would deprive Iraq of access to the oil revenues it earns from global markets, quickly triggering a financial collapse.

According to 2025 figures, these revenues account for about 88 percent of Iraq’s federal budget. Even if the Trump administration refrains from such a drastic step, it has other, more gradual options with similar effects, such as imposing sanctions on Iraqi institutions and officials involved in supporting Iranian influence and violating the U.S. sanctions regime against Iran.

There is now a broad consensus in the Iraqi political scene that Maliki has lost any hope of returning to office. Yet he continues to press ahead with his candidacy, claiming a populist mandate to resist “American interference” even while promising to appease the Trump administration.

He has signaled a willingness to dismantle Iran-aligned armed factions, distance Iraq from Iranian influence, and build positive relations with America’s new regional ally, post-Assad Syria. Iraqis remember well, however, that it was Maliki who played a central role in creating the militias and drawing Iraq into Iran’s sphere of influence. He was also, at first, scathing about the rise of ex-jihadi Ahmed al-Sharaa to the Syrian presidency – until he wasn’t.

Trump’s stance echoes an earlier (though subtler) American rejection of Maliki. In 2014, the Obama administration declared that it would halt military aid to Iraq if Maliki won a third term as prime minister. The Americans blamed Maliki’s polarizing politics for weakening Iraq amid the threat from ISIS, which ultimately managed to conquer a third of the country. Washington’s position effectively sidelined Maliki. Over the following four years, under the U.S.-backed premiership of Haider al-Abadi, Iraq managed to regain some stability and liberate its territory from ISIS control in 2017, creating a general sense that the country had overcome the worst and that better years lay ahead.

It soon became clear, however, that the ruling Shiite alliance continued to allow the Iran-aligned militias to expand their political, economic, and institutional influence – not least thanks to Maliki. Today, as a result, members of these factions run ministries, contest elections, and secure increasing parliamentary representation. Iran has effectively achieved dominated Iraq’s political institutions. This is not only bad for Washington; it is bad for Iraqis, too.

The Hamas attack on Israel in October 2023, the strong Israeli response, and Trump’s return to the presidency have all driven a shift in U.S. policy toward Iraq. Until 2025, Washington pursued a strategy of patient – and ultimately futile – cooperative investment in successive Iraqi governments in order to help them thwart Iranian influence. That effort did not bear fruit.

Now the Americans have abandoned that supportive approach in favor of peremptory demands:

Iraq must dismantle Iranian influence within its borders and can expect negative consequences if it fails to do so. This is precisely the message Secretary of State Marco Rubio conveyed to Al-Sudani in a series of phone calls last year. Trump’s public no-confidence measure represents the culmination of this pressure-based strategy, one that places full responsibility for Baghdad’s choices squarely on Iraq itself.

Although Maliki remains committed to his candidacy, the Iraqi political class understands that defying the Trump administration would amount to political and economic suicide. The ex-prime minister’s chances have evaporated.

Yet the latest news has merely served to obscure the deeper question: Is there any potential prime minister actually capable of dismantling Iranian influence? The natural addressee of this question is none other than the Shiite alliance itself. Only by agreeing on this objective would it be in a position to provide the necessary political cover and institutional support for the next prime minister to carry out this task. The key question, then, is whether Trump’s rejection of Maliki will finally push the alliance to do the right thing.

***********************************************************************************************

EXPERT: IGNORING US THREATS COULD PLUNGE IRAQ INTO COMPLEX CRISES

Strategic affairs expert Hussein Al-Asaad confirmed on Saturday (February 14, 2026) that the United States’ threats to impose sanctions on Iraq if any new government is formed that does not have its approval must be taken very seriously and carefully considered, given their potential repercussions on the political, economic and financial stability of the country.

Al-Asaad told Baghdad Today that “Washington has multiple pressure tools, starting with financial and banking sanctions, and not ending with economic and trade restrictions, in addition to its direct impact on Iraq’s relationship with international institutions and foreign investments. Any escalation in this matter may negatively affect the value of the national currency, market activity, and the financing of vital projects.”

He explained that “the current stage requires Iraqi political forces to adopt a realistic and balanced approach, based on protecting national sovereignty on the one hand, and avoiding entering into uncalculated clashes with influential international powers on the other, especially in light of the sensitive regional conditions and internal economic challenges.”

He added that “the formation of the government must be based on a broad national consensus and a clear government program that reassures the international community about Iraq’s commitments, while at the same time preserving its independent decision-making. Ignoring or downplaying American warnings may open the door to complex crises, the price of which will be paid primarily by the citizens.”

Al-Asaad concluded by saying that “managing this file requires active diplomacy, responsible political dialogue, and a strategic vision that protects Iraq’s higher interests and prevents the use of sanctions as a tool of pressure that hinders the path of stability and state-building in the next stage.”

From time to time, political and economic warnings are raised in Iraq that any tension with influential international powers, especially in financial and economic matters, may affect market activity, investments, and foreign transactions, prompting some parties to call for a balance that combines preserving national decision-making with avoiding escalation.

***************************************************************************************************

MORE SEVERE THAN THE 1991 EMBARGO… WHAT IS THE NATURE OF THE AMERICAN SANCTIONS THREATENING IRAQ?

Hoshyar Zebari, a leader in the Kurdistan Democratic Party, stated that the United States has threatened Iraq with sanctions even harsher than those imposed in 1991, including the SOMO company, the Central Bank, and other institutions .

Zebari said in a televised interview followed by Al-Sa’a Network, “America has confirmed that it will not deal with any government that includes representatives of some factions listed on the terrorism or sanctions lists of the Treasury Department, and they will not deal with any government, even with ministries occupied by those affiliated with the factions .”

He added that “America has threatened sanctions against SOMO, the Central Bank, and dollar flows, sanctions that are more severe than the 1991 embargo,” noting that “Washington has confirmed that it will not finance any regime or government that violates its sanctions .”

Earlier, US President Donald Trump stated that Iraq might be making a grave mistake by reinstating former Prime Minister Nouri al-Maliki as head of the next government .

He added that “the United States will stop helping Iraq if he is elected, and if we are not there to provide assistance, Iraq will have no chance of success, prosperity, or freedo.

*********************************************************************************************

ADVISOR TO THE PRIME MINISTER: PUBLIC FINANCES FOR 2026 HAVE ENTERED THE PRACTICAL IMPLEMENTATION PHASE.

Attention is focused on revenue indicators and public spending patterns as the clearest measure of economic stability. With the continued flow of oil revenues, the issue of salaries has emerged as a top priority for a large segment of society, and assurances have been given that salaries are secured.

The Prime Minister’s financial advisor, Mazhar Muhammad Salih, stated that “public finances for 2026 have entered the practical implementation phase of the provisions of the amended Federal Financial Management Law No. (6) of 2019, which mandates securing monthly resources of the highest priority to cover mandatory expenditures, primarily employee salaries, pensions, and social welfare allocations, estimated at approximately (8) trillion Iraqi dinars per month.”

These obligations constitute the core of current social spending, necessitating meticulous liquidity management and strict regulation of spending priorities, especially given the application of the (1/12) rule of actual current expenditures for the previous year (2025) in the absence of a valid annual budget.

***********************************************************************************************

ON ONE CONDITION… MALIKI THREATENS TO WITHDRAW, AND AL-SHATRI TOPS THE LIST OF CANDIDATES TO SUCCEED HIM.

As the political deadlock continues to grip Iraq, new information and reports have revealed the conditions set by the leader of the State of Law Coalition, Nouri al-Maliki, in exchange for withdrawing his candidacy for the position of Prime Minister, coinciding with talk of intense international pressure to exclude him from the scene.

In this regard, Mahmoud al-Hayani, a member of the Coordination Framework, told Kurdistan24, “Nouri al-Maliki is prepared to withdraw his candidacy on one condition only: that the leaders of the Coordination Framework unanimously or by majority vote request him to do so.” Al-Hayani emphasized that al-Maliki has no intention of backing down under any external pressure, stressing that the decision remains contingent upon consensus within the Shia political bloc.

On the other hand, media sources reported that a new American message was sent to the leaders of the Coordination Framework last night, in which Washington clearly expressed its opposition to Nouri al-Maliki assuming the premiership again, stressing its categorical rejection of this option.

Should Maliki withdraw, political analysts suggest a shift in the chances of other candidates. Ali Fahd, a member of the Hikma Movement, revealed that Hamid al-Shatri’s name is now being floated as the strongest alternative candidate. Fahd explained that “al-Shatri has the best chance because he enjoys wider acceptance and is less controversial both domestically and internationally.”

The information also indicates that Maliki’s withdrawal from the race may directly weaken the chances of candidate Mohammed Shia al-Sudani of obtaining the position, thus opening the door to entirely new options.

So far, the meetings of the coordination framework aimed at resolving the issue of the prime ministership are still suspended, without setting a date for them to be held soon, which reflects the depth of the divisions and internal disagreements among the Shiite forces regarding the personality of the next prime minister.

(bla, bla, bla, bla, bla…… lol….)

***************************************************************************************************

ASA’IB AHL AL-HAQ: 7 PARTIES WITHIN THE FRAMEWORK ARE DEMANDING THE WITHDRAWAL OF AL-MALIKI’S NOMINATION.

A member of the political bureau of the Asaib movement stated that there are 6 parties within the coordination framework who oppose the nomination of Nouri al-Maliki for the premiership, expecting that a seventh Shiite party will join the front of those demanding the withdrawal of the nomination tonight .

Al-Shihani said in a televised interview followed by Al-Sa’a Network: “I contacted 3 of the leaders of the framework who voted in favor of Al-Maliki at the framework meeting, and I found that they were very concerned about the recent threats, and they said frankly that they have a new opinion regarding Al-Maliki’s nomination .”

He continued: “Through calculations I made regarding those who reject al-Maliki’s nomination, starting with Sadiqun, I found 6 leaders who reject it, and I was told that there is a seventh who will join them tonight in the matter of withdrawing the nomination,” noting that “the American threats included imposing sanctions on the Ministries of Defense and Foreign Affairs, in addition to the Central Bank and SOMO .”

He pointed out that “the Kurds and Sunnis will not come to parliament to vote for a president who would task Maliki with the premiership, and today the respected Maliki is supposed to ‘fear God’ in his dealings with the Iraqis, and he is worthy of that .”

He asked: “Why do we condemn today the impact of the American decision on the Sunnis and Kurds, and not criticize the Shiites who are influenced by the blessing that comes from Iran?”

***********************************************************************************************

“WITHDRAWING AL-MALIKI’S NOMINATION”… TONIGHT, REQUEST NUMBER 7 WILL APPEAR ON THE ASA’IB ACCOUNT.

Amid the Shiite framework’s inability to hold a meeting despite successive attempts since Sunday, a member of the Asa’ib Ahl al-Haq movement’s political bureau said that the American threat, which began to indicate the punishment of Iraqi ministries such as Defense and Foreign Affairs, caused positions to change rapidly, to the point that the parties opposing Nouri al-Maliki’s nomination for the premiership became 6 members of the coordinating framework, after it was only 3. Moreover, Hussein al-Shehani, who was speaking in a dialogue with journalist Ali Imad, which was followed by 964 Network, expects a seventh Shiite party to join the front demanding the withdrawal of the (peanut-head) nomination tonight.

Hussein Al-Shehani:

I contacted three of the leaders of the framework who voted in favor of Mr. Maliki at the framework meeting, and I found them very concerned about the recent threats. They said frankly that they had a new opinion regarding the nomination of Mr. Maliki. Through calculations I made of those who rejected the nomination of Mr. Maliki, starting with Sadiqun, I found 6 leaders who rejected it, and I was told that there is a seventh who will join them tonight, regarding the issue of withdrawing the nomination of Mr. Maliki.

The US threats included imposing sanctions on the Ministries of Defense and Foreign Affairs, the Central Bank, and SOMO.

I say, “God help the framework” if it changes its choices. There will be voices of support from the Brotherhood within the State of Law coalition, especially those close to Maliki. Today we have moved beyond the issue of being influenced by the tweet.

The Kurds and Sunnis will not come to parliament to vote for a president who would appoint Mr. Maliki as prime minister. Today, Mr. Maliki, the respected one, is supposed to “fear God” in his dealings with the Iraqis, and he is worthy of this.

Why do we condemn the Sunnis and Kurds today for being influenced by the American decision, and not criticize the Shiites who are sometimes influenced and “enjoy” the blessing that comes from Iran? For example, if an explicit prohibition came from Iran – God forbid that Iran would do that – like Trump’s tweet, then they would certainly be influenced.

***********************************************************************************************

“CRUCIAL” WEEK FOR IRAN AND THE POSSIBILITY OF A US ATTACK

As senior US officials traveled to Tel Aviv, Israel’s Channel 13, referring to the possibility of a US attack on the Islamic Republic, called this week “decisive and deadly” for Iran and the United States.

Brad Cooper, commander of the U.S. Central Command (CENTCOM), arrived in Israel on Saturday and met with Israeli Chief of Staff Eyal Zamir at the Defense Ministry headquarters in Tel Aviv.

The meeting was also attended by the head of Israeli military intelligence and the head of the organization’s operations department.

“US President Donald Trump has not yet made a decisive decision to attack Iran,” Cooper said, according to Israel’s Channel

Cooper also confirmed that the United States will complete the preparations for a possible operation against Iran by the end of the week.

“Senior Israeli army officials have conveyed their country’s position to the Americans, according to which the initial attack on Iran must include specific military objectives,” Channel 13 added.

According to Israel, in addition to attacking government institutions in order to encourage the Iranian people to overthrow the Islamic Republic, US warplanes should also target surface-to-air missile systems on Iranian soil.

-Wittkoff and Kushner visit Israel

The Centcom commander’s trip to Tel Aviv came amid a backlash that has seen the Israeli army on full alert in recent weeks along with an increased U.S. military presence in the region.

In another development, US special envoys Steve Witkoff and Jared Kushner arrived in Tel Aviv for talks with Israeli Prime Minister Benjamin Netanyahu.

The talks will focus on developments in the Gaza war and political and security coordination between the United States and Israel, the Times of Israel news agency reported, citing informed sources.

– US military options against the Islamic Republic

According to reports, Trump has not ruled out a military attack against the Islamic Republic.

With the beginning of the protests in Iran on December 28, 2025 and the significant participation of cities and towns across Iran that began with the economic crisis, currency collapse, inflation, and living standards, but extended to political demands Avoid protests.

In recent days, Trump has revealed that he has moved a “military boat” to the area and expressed hope that it will not need to be used.

– Military movements in the region

The aircraft carrier “USS Abraham Lincoln” and three escort destroyers have sailed west from the South China Sea and are now stationed in the Indian Ocean, according to a U.S. Navy official.

The ship is expected to join other US military units in the Persian Gulf and Bahrain in the coming days.

Meanwhile, the British Defense Ministry said it would send Typhoon fighter jets to Qatar “as part of defense activities.

Dozens of US military transport planes are reportedly heading to the area.

Meanwhile, the Israeli newspaper Hayom reported that the Israeli government has provided Washington with information about mass executions in Iran, contrary to assurances received by Trump from Islamic Republic officials.

Trump had previously said one of the reasons for delaying the attack on Iran was to cancel the executions of more than 800 protesters arrested during the protests. But the Islamic Republic denied Trump’s remarks.

According to the Israeli newspaper Hayom, contrary to Iranian officials’ claims, the information available to the US government and collected and handed over by Israel contains conclusive evidence of the execution of demonstrators in various ways and Israel was involved in obtaining this information.

In response, a senior Iranian official told Reuters that Tehran viewed any attack by the United States and Israel as an “all-out war.

“Everything in Iran is on high alert and Iran is ready for the worst-case scenario,” he added.

Therefore, based on these reports, the United States is likely to make a decisive decision about Iran and the Tehran authorities this week, and the possibility of a military attack and a new round of war could be one of the US options against the Islamic Republic.

**************************************************************************************************

THE US 7 DEMANDS ON IRANIAN INFLUENCE IN BAGHDAD

The letter places heavy emphasis on reducing Iranian influence in Baghdad’s political and security affairs amid ongoing US-Iran tensions and Iraq’s prolonged government formation process following the November 2025 elections.

The letter underscores how Iraq’s government formation has become a key arena in the larger US-Iran contest for regional dominance

The United States delivered a pointed diplomatic message to Iraqi leaders, outlining seven specific demands for the selection and performance of the country’s next prime minister.

The letter, reported by Al-Monitor on Thursday, places heavy emphasis on reducing Iranian influence in Baghdad’s political and security affairs amid ongoing US-Iran tensions and Iraq’s prolonged government formation process following the November 2025 elections.

The seven demands

According to sources familiar with the correspondence, the US letter specifies the following conditions for the incoming prime minister and the government they lead:

- Elect a prime minister who prioritizes Iraqi national interests above external alignments, particularly those tied to Tehran.

- Institutionalize and bring the Popular Mobilization Units (PMU) — a coalition of mostly Shia militias, many backed by Iran — fully under state control, limiting their independent operations.

- Reduce corruption and combat money laundering, with a focus on disrupting illicit financial networks that benefit Iranian-aligned groups.

- Limit or exclude Iranian-backed militias from key positions in the new cabinet and security apparatus.

- Strengthen Iraq’s sovereignty by curbing foreign interference, especially from Iran, in domestic governance and decision-making.

- Enhance cooperation with the United States on security, counterterrorism, and economic matters as a partner rather than a conduit for regional rivals.

- Implement reforms to promote inclusive governance, economic diversification away from oil dependency, and accountability to prevent sectarian divisions.

The demands reflect the Trump administration’s broader strategy to weaken Iran’s regional proxy network, particularly in Iraq, where Tehran has long exerted influence through political parties, militias, and economic ties.

Context amid government formation deadlock

Iraq remains without a new government more than three months after parliamentary elections, with the Shia Coordination Framework — the largest bloc — initially nominating former Prime Minister Nouri al-Maliki in late January 2026. Maliki, who served from 2006 to 2011, is widely viewed in Washington as closely aligned with Iran and responsible for sectarian policies that fueled instability and the rise of ISIS.

President Donald Trump publicly rejected Maliki’s candidacy on Truth Social in late January, warning that the US would “no longer help Iraq” if he returned to power. Subsequent reports indicated threats of severe measures, including restrictions on Iraq’s access to oil revenues held at the Federal Reserve Bank of New York — a lifeline accounting for roughly 90% of the federal budget.

The US letter, delivered amid these pressures, appears to formalize Washington’s red lines. It builds on earlier warnings, including potential sanctions against Iraq’s Central Bank, Oil Ministry, and officials linked to Iranian-backed groups if Maliki’s nomination persists.

Some Framework factions have since signaled willingness to reconsider Maliki, with reports suggesting a possible extension of caretaker Prime Minister Mohammad Shia al-Sudani’s term or selection of a compromise figure acceptable to both domestic stakeholders and Washington.

Broader geopolitical stakes

The demands arrive as US-Iran indirect negotiations continue, with Washington pushing Tehran to curb its nuclear program, ballistic missiles, and support for proxies — including Iraqi militias. Iraq sits at the heart of this rivalry: US forces maintain a presence for counter-ISIS operations, while Iranian-aligned groups have targeted American interests in the past.

By conditioning future cooperation — and implicitly threatening economic leverage — on compliance, the US seeks to reshape Iraq’s political landscape.

Analysts note that success could enhance Iraqi sovereignty and stability, but failure risks deepening divisions or triggering financial crisis.

***************************************************************************************************

YOU HEAR ABOUT CORRUPTION BUT DON’T KNOW HOW IT GOES ON? HERE ARE THE DETAILS OF HOW CONTRACTS ARE MANIPULATED, AND THE THEFT AND LOOTING ARE CARRIED OUT, IN “NUMBERS” – URGENT

Please go to link for the entire article. It is very long.

The average Iraqi hears the word “corruption” almost every day, as it has become a constant backdrop in political speeches, oversight reports, and café conversations. But what he sees firsthand is far simpler than these grand pronouncements: a street that has been repaved multiple times only to crack again with the first rain, a “renovated” school whose roof still leaks, a new hospital but lacking sufficient equipment or a full staff.

In a remote neighborhood, elementary school students leave their classrooms after the first downpour of the season. The road leading to the school is riddled with potholes and stagnant water, and the schoolyard has turned into sticky mud. Just months ago, a local official appeared on television announcing the “completion of a major road and school rehabilitation project in the district.” That evening, a parent sits watching the news and hears about the launch of a new service project, “bigger than the previous one,” to improve the same situation. His son turns to him and asks, “Why do they fix the street every year only for it to fall apart again?” The father replies bitterly, “The street remains the same, but the contracts get bigger.”

This discrepancy between what is declared on paper and what people experience on the ground is the best entry point for understanding corruption, not merely as stealing money in a contract here or a deal there, but as an integrated system that begins from the moment the project is conceived and does not end with impunity.

How is a corrupt deal created from the moment of the idea?

In many cases, the story begins long before the contract is signed, at the moment the “project idea” is presented. An attractive title is used: “development,” “rehabilitation,” “reconstruction,” and a narrative of importance and necessity is woven around it. At this initial stage, the estimated cost is presented inflated above the actual market price, and the technical specifications and conditions are formulated in a seemingly professional manner, but in reality, they narrow the scope of genuine competition and pave the way for a limited number of companies with political or commercial ties to influential entities.

When the time comes to open bids, the picture on the surface looks competitive: numerous files, bank guarantees, and offers varying in price. But behind closed doors, technicalities become weapons: a missing signature on a minor page, a small error in a bank statement, a rigid interpretation of a clause in the advertisement. With these pretexts, the cheapest or most professional bids are rejected, and the highest-priced offer passes as the “only one that meets the requirements.”

After the contract is signed, the implementation phase begins. The materials stipulated in the contract are replaced with lower-quality ones, or the actual work on the ground is reduced while the payment amounts remain the same. Deadlines are extended under various pretexts to incur additional costs. On paper, the project is 100% complete, but in reality, the street reverts to its original state after a single rainy season, and the school requires further maintenance after a few years. It’s as if the contract was merely a fleeting moment in the history of corruption, not a genuine contribution to infrastructure development.

**********************************************************************************************

AMONG THEM IS “WITHDRAWING HIS CANDIDACY”… THE OPTIONS FOR THE COORDINATION FRAMEWORK REGARDING MALIKI HAVE BEEN REVEALED

On January 24, 2026, the Coordination Framework announced the nomination of Nouri al-Maliki, head of the State of Law Coalition, for the position of Prime Minister, with a majority vote from its constituent groups.

Informed sources confirmed on Saturday that the forces of the Coordination Framework are planning to hold an expanded meeting to end the political deadlock by deciding on Nouri al-Maliki’s nomination for the premiership, either by keeping him or replacing him.

Sources told Shafaq News Agency that “the coordination framework, which brings together the Shiite political forces, is moving towards holding a meeting to end the political deadlock and agree on a unified position regarding the prime minister candidate.”

He adds that “the current approach is to choose a figure who suits the circumstances surrounding the country and the economic and security challenges, provided that a date is set for the parliament session to elect the president of the republic, who in turn will task the framework candidate with forming the government.”

He pointed out that “the meeting will address the issue of the continued nomination of the head of the State of Law Coalition, Nouri al-Maliki, or his personal withdrawal, or the framework will decide to officially withdraw his nomination and look for an alternative.”

The “coordination framework,” which includes ruling Shiite political forces in Iraq, is witnessing a division over the nomination of Maliki for the next government, amid American warnings of the repercussions of his selection, which prompted forces within the coalition to try to persuade him to withdraw in order to preserve the unity of the framework.

In contrast, Maliki has declared on more than one occasion his adherence to his candidacy and believes that withdrawing from it should be done by an official decision from the framework.

The escalating American pressure on Iraq comes as a translation of President Donald Trump’s explicit threats, which included criticism of the previous course taken by Maliki when he assumed the premiership for 8 years.

************************************************************************************************

Their words not mine…..No Rumors, No Hype, No Opinions ,,,,,

Just the FACTS!

Disclaimer: All information in this newsletter is not intended for investment decisions / purposes. Mnt Goat is not a financial analyst, planner, banker, attorney or associated in any role with giving out professional investment advice.

Auf Wiedersehen

Much love to ya all,

Mnt Goat

*****************************************************************************************************

This is what I’m doing, I suggest you all do the same. There are promises in here that are part of your heritage as a believer in Jesus Christ; receive them Don’t let anyone steal your blessing. I pray your faith fail not:

O give thanks unto the LORD; for he is good: because his mercy endureth for ever.

Let Israel now say, that his mercy endureth for ever.

Let the house of Aaron now say, that his mercy endureth for ever.

Let them now that fear the LORD say, that his mercy endureth for ever.

I called upon the LORD in distress: the LORD answered me, and set me in a large place.

The LORD is on my side; I will not fear: what can man do unto me?

The LORD taketh my part with them that help me: therefore shall I see my desire upon them that hate me.

It is better to trust in the LORD than to put confidence in man.

It is better to trust in the LORD than to put confidence in princes.

All nations compassed me about: but in the name of the LORD will I destroy them.

They compassed me about; yea, they compassed me about: but in the name of the LORD I will destroy them.

They compassed me about like bees; they are quenched as the fire of thorns: for in the name of the LORD I will destroy them.

Thou hast thrust sore at me that I might fall: but the LORD helped me.

The LORD is my strength and song, and is become my salvation.

The voice of rejoicing and salvation is in the tabernacles of the righteous: the right hand of the LORD doeth valiantly.

The right hand of the LORD is exalted: the right hand of the LORD doeth valiantly.

I shall not die, but live, and declare the works of the LORD.

The LORD hath chastened me sore: but he hath not given me over unto death.

Open to me the gates of righteousness: I will go into them, and I will praise the LORD:

This gate of the LORD, into which the righteous shall enter.

I will praise thee: for thou hast heard me, and art become my salvation.

The stone which the builders refused is become the head stone of the corner.

This is the LORD’S doing; it is marvellous in our eyes.

This is the day which the LORD hath made; we will rejoice and be glad in it.

Save now, I beseech thee, O LORD: O LORD, I beseech thee, send now prosperity.

Blessed be he that cometh in the name of the LORD: we have blessed you out of the house of the LORD.

God is the LORD, which hath shewed us light: bind the sacrifice with cords, even unto the horns of the altar.

Thou art my God, and I will praise thee: thou art my God, I will exalt thee.

O give thanks unto the LORD; for he is good: for his mercy endureth for ever.

LikeLiked by 3 people

The militia issue is a hugely pervasive and destructive influence. One that Iraq is going to have to deal with quickly and decisively.

Obviously the previous administration’s were captured by globalist factions, intent on moving into their “one world order” with no regard for national sovereignty and what would be best for individual countries.

The power plays and manipulation on a grand scale are indicative of the monumental tasks facing leaders intent on fostering a more desirable direction for the populations of each country to move towards.

It does sound like Iraq is now moving to the end game, towards revaluing their currency and returning to the world stage finally. We can only hope and pray that they finally do pull together as a people to achieve that which is best for their country. They must decouple from Iranian influence to do so, this is clearly non-negotiable and absolutely in their own best interest.

May they stay the course and aggressively pursue finalizing their initiatives to successfully realize their goals. Which would concurrently be a very stabilizing influence in the middle eastern region of the world.

LikeLiked by 1 person

Yes removing iran backed militias from iraq is key/ important to US/trump/RI however I think iraq/sudani need to step up and remove them via laws/iraqi armed forces/military to truly show that iraq is sovereign and able to stand on its own two feet. The us will play a hand in recon/intel but IMO the removal needs to be executed by iraq. I personally dont care how it gets done but for optics sake I feel it should play out as stated above…. love Mountain Goat your the real MVP

LikeLiked by 1 person

Thank you Mountain Goat for all your efforts over the past 13 years! You are the only one that doesn’t hype things up and thinks about what is going by connecting information over time.

This is a difficult subject matter! Iraq is in a pickle since they have been paying Iran in dinar for electricity. Who knows how much dinar Iran is actually holding? How much dinar is Iran getting from imports into Iraq?

So if you don’t want Iran to capitalize on this issue – US wishes – how would you go about this?

Developing other sources for electricity – Jordan connection and Saudi Arabia ring a bell? And the conversion of existing power plants in Iraq to run on gas or oil?

Need to be able to refine your own oil for gasoline and perhaps export excess capacity.

Get your exports to exceed what you import – relative to Iran – and require payment in dinar. Draws a demand for the Iraqi dinar. Pay for oil in dinar perhaps. Sell raw materials in dinar – export!

While oil has been the primary export it has been paid for in US dollars. If Iraq demanded that all oil exports are to be paid in Iraqi dinar the demand for the currency would be huge and support a revaluation.

The issue with Iran will still be there though. How do you remove the militia?

At this point the Militia have been there for 10 plus years. They have infiltrated the political system and have established controlled territories both politically and physically. Its like the mafia.

Removing them will be difficult and perhaps it could send Iraq into another war! Iran may or may not openly continue to support these militias but the militias have control and they will not want to leave without some sort of payment!

Alternatively – they can stop paying them as part of the Iraqi Army and discharge them! Then usher them out of the country one militia group at a time with the Iraqi Army. They just won’t be able to do all the militia at the same time.

I believe Trump has already negotiated with Iran about supporting the militias in Iraq and the entire middle east area. After the bombing of Iran, Iran realizes that their defenses are not a match for the US and they are vulnerable to air attacks.

Ridding the Militia in Iraq will be required before any reinstatement of the currency. They definitely waited to long to reinstate the currency and should have done it back in 2013.

Obama didn’t want them to do it in 2013 but rather supported an uprising in Syria! Thus, Maliki let prisoners’ out of jail in the Mosul area and Obama had the military pull out and leave all the equipment behind for them to have.

I believe Iraq has already started to dismantle the Iranian militia in Iraq in certain areas. There was an article about 3 months ago that you posted. It was worded in a way that was politically correct but had to do with the Iraqi Army going in to clean out a trouble area.

LikeLike

SHAFAQ NEWS Saturday October 25 2025

“Iraq has officially begun distributing lower denomination currency notes

including the 50 dinar bill as part of its broader monetary reform strategy.

The release is intended to facilitate everyday transactions and reduce the

reliance on larger denominations.”

Channel 8 Sunday October 26 2025

Article with overview and pictures of the old coins and notes