Disclaimer: All information in this newsletter is not intended for investment decisions / purposes. Mnt Goat is not a financial analyst, planner, banker, attorney or associated in any role with giving out professional investment advice.

ABOUT THE NEWSLETTER:

October 21, 2025 Mnt Goat News Brief

Guten Tag everyone:

More concentration on the Comprehensive Banking Reforms and why they are sooooo important for us to get the RV. You’re going to luv this Newsletter today. It is chockfull of goodies.

GIVE A GIFT TO MNT GOAT

I decided to allow everyone to give a Free-will GIFT to Mnt Goat on PayPal if you so desire. Here is the link below. Please show your appreciation for all the hard work I do.

I recommend $10-$15 dollars a month or whatever you can afford. Do you realize I write eight (8) Newsletters every month. This is like a second job to me. The only way I know that people are reading and appreciating all the FACTUAL news I bring is through their appreciation. If I do not receive equal appreciation for all the hard work I do, I will simply end the Newsletter and save myself endless hours at the computer. I am tired of this RV saga just as you are. We are now down to the wire and the evidence is showing us the end is very near. I feel this would be a lousy time to end the Newsletter, but that is all up to you.

So, if you haven’t already shown your appreciation for October please reconsider.

Let’s all try to chip in!

____________________________________

2 Corinthians 8:12

“For if the willingness is there, the gift is acceptable according to what one has, not according to what one does not have.”

More news….

ENERGY EXPERT: 70% OF THE ARTICLES OF THE OIL AND GAS LAW HAVE BEEN AGREED UPON

An oil and gas expert says that 70% of the articles of the oil and gas law have been agreed upon and the rest needs political dialogue and negotiations.

The big picture: The oil and gas law was supposed to be completed in 2007 and voted on in the Iraqi parliament, but due to conflict and indifference of Iraqi parties, year after year, the enactment of the law was hampered.

Official Statement: د. Govand Sherwani, a university professor and oil and gas expert, told AVA that the oil export agreement will help to pass the oil and gas law in the sixth session of the Iraqi parliament, provided there is no political interference. Sherwani said the biggest problem between Erbil and Baghdad on the oil issue is the failure to pass the oil and gas law, which should have been passed in 2007, but fortunately 70% of the articles of the draft law have been agreed.

On the other hand, the expert said that the three-year Iraqi budget law contains many shortcomings and all to the detriment of the Kurdistan Region, if the technical and financial issues are corrected, there is an opportunity in the 2026 budget law.

(Mnt Goat: Oh…Gee-Whiz isn’t this something….. I have been telling everyone for years the Oil and Gas law (HCL) has Not been passed and needs to be passed in order to see the reinstatement. Now do all of you intel idiot gurus reading this article believe me? Yes, you TNT Tony, Bruce (stupid call) and Frank26 and all others. Again, all I can say is “I told you so”.)

______________________________________

STATUS OF THE RV

No! There is no RV or Reinstatement of the Iraqi dinar yet. Don’t let these intel gurus or internet idiots fool you with their hyped-up sites. They only want your clickity-clicks.

We don’t need rumors or bank stories. We don’t need three letter agency lies. We have FACTS and TRUTH on our side and will let them speak for themselves.

I want to start the Newsletter today by saying that the CBI is working with the IMF and the US Treasury behind the scenes to orchestrate the redenomination of the currency. It has NOT officially begun. As I have stated in my last Newsletter dated 10/16 that there is a needed law put in place and voted on in parliament to change out the currency. Oh…. But doesn’t the CBI work independently? Yes, they do, but as I explained in my last Newsletter, they also need a buy-in from the GOI (Finance Committee). I am told this is going to be voted on soon and once it passes we can expect the process to begin. It is mid-October already and I am getting worried. I am told the efforts are still all geared towards a January 2026 reinstatement. We will see what happens.

If you are not familiar with the overall plan to get to the RV, there are sources on my blog to reference to get the understanding of the process. But this will take time on your part and so nothing is easy and no one is going to sum it up in a sentence or two.

The 2011 Dr Shabibi/IMF Plan to Reinstate the Dinar

If they do, they are lying to you as this entire RV sage can get complicated real fast. I feel a bit of sorrow for all the newbies coming into this investment at this time, as it took me years to fully understand what is going on. How can you do it by reading one or two of my Newsletters? The answer is you can’t. We now also have to consider the changes in the US administrations over time and the changes in US foreign policies towards Iraq.

In today’s Newsletter I want to dive a little more into the “evolving” US policy towards Iraq particularly the one now under the Trump administration. Once Trump was elected for a second term, I stated we would have to wait and see how it all shakes out for Iraq. After about 9 months into his term, we are now beginning to see it with more clarity.

If you had listened to any of Donald Trump’s interviews on Iraq prior to his presidencies, you would know his views on Iraqi oil and then connect it to what is now happening. This first article I want to present to you today takes us deeper into this new Trump foreign policy towards Iraq. Why is this important for us to know? It is important because in understanding this policy we can understand the direction of Iraq over these next years and especially in these next few months leading us to the RV. Trump being a business man and now also an educated politician, knows the value of running a tight ship when it comes to profitable businesses. Yes, not all his business ventures were tremendously successful, however he always knew when to cut ties and move on. This could happen to Iraq too.

So, having said this, we can see this attitude in how Iraq is going to be handled by the Trump administration. Trump will try his best to develop Iraq to a profitable economy not for his own wealth but for Iraq and the US taxpayer and the national economies of both nations. His philosophy has always been to assure both parties are making money in any deal. He is now making deals with Iraq.

The first article in the Articles Section is titled “FROM “WE WANT IRAQ’S OIL” TO “MANAGE IT WELL”.. TRUMP’S WARNING OPENS THE DOOR TO AMERICAN INFLUENCE WITH A NEW FORMULA” This article is all telling of the new Trump administration policy towards Iraq. I quote from it “American warnings about the future of Iraqi oil are renewed with US President Donald Trump’s recent statements, which re-shed light on how Iraq’s oil wealth is managed, amid widespread controversy over corruption, declining economic diversification, and continued reliance on rent (oil) as a basic pillar of the general budget.”

“Financial and economic expert Saleh Rashid pointed out that US President Donald Trump’s warnings about Iraqi oil “revealed important facts that Baghdad must take into account”, stressing the need to develop a comprehensive national strategy to invest oil wealth and strengthen the national economy.”

Rashid said in an interview with Baghdad Today, “Trump pointed out that Iraq possesses huge quantities of oil, but it needs effective management.” This shows us investors that Iraq, despite its huge reserves and high production capacity, has relied mainly on government employment after 2003 and until now, as the majority of oil revenues are consumed as operating expenses and a very limited space is allocated to the investment dimension. This has hurt Iraq and so Trump wants to help Iraq turn this around and diversify out of the rentier economy and makes the country less vulnerable to fluctuations in oil prices and the ability to benefit from non-oil revenues.

How much longer must we hear this news about Iraqis desire to diversify. Please, please just do it! They are doing it but it takes time to move out of a socialist economy into a free market economy. It takes investors with the money to invest in Iraq or the oil revenues must be used wisely to develop these sectors. We already seen the oil revenues are not going to do it alone. We know that both have not happened after over 20 years already and they are darkened by corruption.

Years ago, the finance committee told us that Iraq could have been rebuilt then entire post-war Iraq twice over had it not been the nearly two trillion dollars (not dinars) stolen from its oil revenues. Trump is very familiar with these statistics and so he will try to revive Iraq but I have to tell you that, we know from past history with Trump, at some point, if he is unsuccessful, he will pull the plug on his Iraqi project, take his losses and move on. We also have to consider he only has four years to do it. This of course will not be good for Iraq if the US should move on. However, I do not think this will happen. There is too much as stake for the Iraqi people and the US to let this happen.

In my comparison of the upcoming Iraqi elections to the last US election cycles, both are critical elections. I believe for Iraq this election in mid-November is pivotal for Iraq. Al-Sudani is supported by the US. Will he be the candidate selected by the winning party?

Next, I would like to address the ongoing financial reform programs and specifically the “Comprehensive Strategic Banking” or (CSB) reforms. A report issued by the American auditing and financial consulting firm Oliver Wyman on Friday confirmed that banking reforms in Iraq are ushering in a new era of economic growth. WOW! WOW! WOW!

If the GOI had told us this I would not be so excited but when a financial consulting firm like Oliver Wyman says it, I get excited. This new set of banking reforms was identified back in April 2025 and began implementation in September 2025. We have already read a few articles informing us of their progress. Remember the five banks that will be closed, as told in the recent news. It said more may follow.

😊Remember also that these reforms are on the list of the five issues mandated by the US be completed prior to any reinstatement. So, today we get a better look at the nature of these reforms and the progress so far. Holly-Molly!!! WOW! WOW! WOW! There are six (6) articles on this subject matter in the recent news. Do you think this topic is important? I have translated them and put them in the Articles Section for you. Please go and take a peek at them. They do not all say the same thing, and are very informative as to what is going on in the banking sector and how it will revolutionize Iraq’s future and is the gateway to what we want. Get it?

Here are the titles of the six articles: WoW!

- “BAGHDAD CONFIRMS ITS COMMITMENT TO THE ECONOMIC AND FINANCIAL REFORM PROGRAM“

- “BETWEEN REFORM AND DICTATE, THE CENTRAL BANK LEADS BANKS TOWARD A FINANCIAL TRANSFORMATION WITH AN AMERICAN CHARACTER.“

- “FROM WASHINGTON: A NEW BANKING AND ECONOMIC REFORM PACKAGE FOR IRAQ“

- “IRAQ, UNITED STATES US TREASURY ADJUSTS TO WEAKER INTELLIGENCE PICTURE AFTER BANKING CHANGES IN IRAQ“

- “CBI LAUNCHES FULL IMPLEMENTATION OF COMPREHENSIVE BANKING REFORM PROJECT“

- “US REPORT: BANKING REFORMS IN IRAQ USHER IN A NEW ERA OF ECONOMIC GROWTH“

What else is in the news?

😊The other important information in the news stems around the Iraqi relationship with the US in the new foreign policy with Iraq. Please take a look at articles titled “TRUMP APPOINTS MARK SAVAYA AS SPECIAL ENVOY TO IRAQ” and “ZEBARI: APPOINTING SAVAYA IS A BOLD STEP TOWARD RESTORING IRAQ’S SOVEREIGNTY FROM MILITIA RULE.”.

I have to say after reading this set of articles I still firmly believe that this relationship is still in its infancy stages and will hopefully progress much more, once the elections are over in November. I certainly hope Al-Sudani gets another four years, as selecting yet another figure would delay the results and we all know how long these damned elections in Iraq can run. This could even mess with our January 2026 timeframe for the reinstatement.

☹The article titled “WASHINGTON SANCTIONS EXPOSE IRAQ’S SHADOW ECONOMY”, it hammers home with what President Trump already knows and is attempting to fix. It is essentially going to be his new foreign policy for Iraq. See if you can find the five (5) mandated issues in the article, I did. It is a VERY long read but also very informative of the hidden situation in Iraq that many do not want to talk much about. After reading it slowly I got a real sense of the necessary foreign policy of the Trump administration and the work ahead for the US to help Iraq.

Then these articles about Savaya also really display the strategy of the Trump administration towards Iraq. President Trump announced on Sunday the appointment of Mark Savaya as his special envoy to Iraq. Soon after Kurdistan Democratic Party (KDP) leader Hoshyar Zebari said that Trump’s appointment of Mark Savaya is an admission that the situation in the country is “abnormal.” “Mark’s deep understanding of the relationship between Iraq and the United States and his extensive connections in the region will advance the interests of the American people.”

Zebari also said that “Trump’s appointment of Mark Savaya, a Chaldean Christian American of Iraqi origin, as his special representative to stressed that this position requires “measures and decisions outside the usual diplomatic and official frameworks to correct and rectify the turbulent and chaotic situation,” in Iraq. However, Zebari also described the appointment as “good news and a bold decision to restore Iraqi sovereignty and independence, free from corruption, mismanagement of resources, and militia rule.”

In my estimation Trump picked Savaya because he understands the culture, as he is of Iraqi origin. Also, Savaya is going to be Trumps “heavy hitter” in Iraq. Kind of like an economic hitman, but in a good way. There is lots to teach the Iraqis in how to build a solid economy. Like I said prior, that Trump will give Iraq 1000% and then if he still can’t turn it around, he will abandon it and probably slap sanctions on it. It is their choice and probably their last chance to get their act together. What does this mean? It literally means getting each of these five (5) main issues resolved on-time. See my Newsletter dated 9/16 for the list of issues. The one that worries me the most is the situation with the militia from Iran. Iraq will not be a proxy state for Iran if Trump is going to move Iraq ahead in the financial world. It is really that simple and those words come from his mouth, not mine.

What? More GOLD?

😊 In the news this period we find that Iraq again tells us it boost it GOLD reserves in the article titled “IRAQ BOOSTS ITS GOLD RESERVES TO 162.5 TONS”. Since they already told us they have 170 tons of GOLD in previous news, we will go with that figure instead…. Lol..lol..lol.. Iraq continues to boost its gold reserves, with stored quantities increasing from 100 tons to 162.5 tons (170 tons) in recent years, according to an economic expert. Does it also seem weird to you how a past article talks about the 170 tons of GOLD and also then in the same article, talks about the subject matter of deleting the three zeros. Coincidental? I think not! So there is a strong connection of the project to delete the zeros to the amount of GOLD. It all ties together. The key is in the plan to reduce the issued paper notes and then back the dinar with GOLD.

It was pointed out that “increasing gold reserves represents an important step towards strengthening the national economy and supporting financial liquidity, as well as being a strategic safety factor in the face of global market volatility.” I also want to point out once again the CBI plan to back the dinar with GOLD. Remember the plan is to shrink the size of the issued paper currency by two-thirds in the process of conducting the Project to redenominate the dinar to the newer lower notes. This means less currency to print and replace too in the future. According to my CBI contact the strategic plan of the CBI has been all along to digitize the dinar and get the citizens using electronic payments (debit cards) instead of cash. This will allow the shrinkage of the paper notes in circulation. I also want to point out a liability too. The liability is that once they conduct the Project to Delete the Zeros, our dinar notes still exists in circulation and so there are many incentives to get these notes out of circulation. This has to be done on or around the same time of the Project to Delete the Zeros for the Reinstatement to be successful.

One incentive is to revalue the dinar just over a dollar in-country to incentive the citizens to turn them into the bank. The next incentive is for the CBI to collect as many of these larger three zeros notes in foreign countries to get them out of circulation once and for all, then the US has an incentive to have us investors exchange our three zero notes for oil credits (I have already explained why this last incentive is important to the US in my Newsletter dated 10/14). Then there is us investors who want to exchange these notes and get rich…. Lol…lol…lol.. 😊

Remember that this is a switch-over back to normalize the dinar to normal notes. Remember that 21 years ago they did just the opposite when in 2004 they went from normal notes (Saddam Heissen notes) to the three zero notes. Now they have to revert back and so this is really all the project to delete the zeros is. But I also want to point out that in 2004 the move to the three zero notes also killed the rate of the dinar and so they will also revert the rate back too. This is where our RV comes in. Again, this is the IMF term called Normalization of Currency, this is part of it for Iraq.

IMF Normalization of Currency

“The IMF’s normalization of currency refers to the process where the organization helps countries return to a more neutral monetary policy stance after a period of unconventional policies. This process involves tightening financing conditions by raising key interest rates and shifting from unconventional monetary policy measures towards conventional interest rate policy. The IMF’s role is to coordinate efforts that maintain balanced currency relations among nations and to prevent disruptive currency fluctuations that may hinder global economic stability.”

So, again I have to ask you as a reader of this analysis- What do you think is happening? Are they going to move ahead this time with removing the zeros or not?

We must continue our prayers for the Iraqi people and the future of Iraq. Let God’s abundance and prosperity rein down upon that nation.

Q & A

Question from: Train Sys

While I understand the difference between the exchange rate and the removal of zeros, my concern is this: when the time eventually comes to exchange the existing 25,000-IQD notes here in the US, could they be recognized as having the value of only 25 new dinars based on the current articles?

Answer: Mnt Goat

Guten Tag Train Sys, whatever that means….? Thanks for the question. But I don’t think you have a full grasp of what is about to happen. Are you a newbie? I want to answer your concern and it is easy to do since we must just stick to the plan of how to get to the reinstatement which means back to FOREX as told to us by Dr Shabibi and the IMF in 2011. No worries if you would just listen to the plan. The CBI told us that these three zeros notes would be used for “inter-banking” transactions when large sums of cash are needed. Large sums of cash? Yes, after the reinstatement and revaluation a 10,000 note may be worth as much as $40,000 US Dollars. But this goes deeper. The CBI also told us that these large notes would be around for up to 10 more years after the Project to Delete the Zeros, which tells me the Project to Delete the Zeros and the Reinstatement are interconnected in the plan and one must follow the other.

Remember we can’t exchange our dinars until the IQD is reinstated (back on the Foreign Exchange FOREX). The reason why it is taking so long is because they want to use the dinar in a financial “reset” or better called a “wealth transfer”. To do this they need the rate of the dinar to US dollars very high. There are also oil credits to think about and so Iraq must be ready financially to pay on these credits in oil. In other words, they must diversify their economy or increase their oil production to pay for the RV. We are now hearing they are doing both. Sadly, there is also the corruption with Iran that must be corrected too and so let’s not forget about it.

Also, if you read my very recent Newsletters you would know that in order to use the oil credits from our exchange, Iraq must also be in a position to afford for the US to use the oil credits. The US is going to get repaid back for the 2003 war and then some. Hey…it’s all in the news articles and I addressed all of it many times already.

Seems you are listening other intel guru idiots? The concern about our three zero notes not being any good is not a valid one. Again, we must go back to the 2011 plan. I have just given you all the reasons why our dinars are solid and we will exchange and make millions.

______________________________

________________________________________

Their words not mine…..No Rumors, No Hype, No Opinions ,,,,,

Just the FACTS!

PRAYING WITH SINCERITY

Many may ask why their prayers are not being answered. Our new Shepard in Rome Pope Leo XIV has given us some direction.

You can purchase a nice pair of Rosary Beads here to pray:

These prophecies are more important now more than ever. They give us the strength, perseverance and hope that a better time is coming and that God’s Hand is at work behind the scenes. If you just take a second even to look around you at these past three election cycles, how can you deny that God is at work? Are you sleeping or what?

It is amazing and there is no other way that these events could have happened the way they turned out. But there is more to come, much, much more, I assure you! Now that God has his biblical David re-elected, we need to pay attention to what He does next.

NOTE: These prophecies just keep getting better and better, giving us HOPE of a brighter future. But the real reason why I listen to them is that we can actually see what God says He will do is taking place right in front of our noses. It is a confirmation to me that God is real and is still with us forever just as in biblical times.

Prophetic Words from prophet: Julie Green

“ FIRE IS COMING ”

You can start watching the video at the 23:41 mark.

_____________________________________________________________

SILVER VAULTS RUN DRY AS SHORTAGE TRIGGERS PANIC. Physical silver not available to meet demand.

Okay so why is there a shortage of silver all of a sudden? There is a shortage because many investors who invested in silver only on paper are now wanting the actual physical silver. The procedure of buying without taking possession has kept silver relatively lower over many decades than what it should be. Silver should be at about 1/3 the spot of GOLD. Gold just hit $4,000 an ounce and technically silver should follow at about $1,000 – 1,300 an ounce.

Just this week silver finally broke over $50 an ounce and so what did our prophets tell us would happen next. They said a sudden rise in silver would happen. Will it? It’s happening now. Now investors are demanding their silver and there is not enough to meet the demand. Yes, it’s kind of like a panic for silver.

It is key to the “RESET”.

Folks, this is not just precious metal dealers trying to sell you silver or gold. Listen carefully. What’s coming next? I am trying to help everyone that there is money to be made on other than currencies, such as in the dinar that we all sucked up in the past.

15 THINGS TO DO IF YOU GET RICH ALL OF A SUDDEN

15 ASSETS THAT ARE MAKING PEOPLE RICH/RICHER

HERE’S HOW TO MAKE YOUR ASSETS INVISIBLE FROM CREDITORS

JUST THE FACTS OF THE SCHUMER SHUTDOWN

No, it is not going to be democrat business as usual! A shift in how the government is going to be run in the future, and the future is now.

IS IT TIME FOR JUSTICE FOR JACK SMITH

“No one is above the law” and this applies to you too Jack. Did he have legal justification to spy on nearly a dozen republican senators and tap their phone lines? What about what he did to Trump?

THE “SHIT” IS ABOUT TO HIT THE FAN FOR SHIFTY SHIT-SCHIFF.

Will he be next on the list of people indicted? It’s coming….trust me on this one.

IT IS REVEALED ‘NO KINGS’ RALLIES SPONSORED BY COMMUNIST PARTY IN USA

I guess Soros and the CCP couldn’t even pay the paid protestors enough to come out and riot. Did you ever see a bigger bunch of bullshit?

SCHUMER IS PREPARING TO SURRENDER

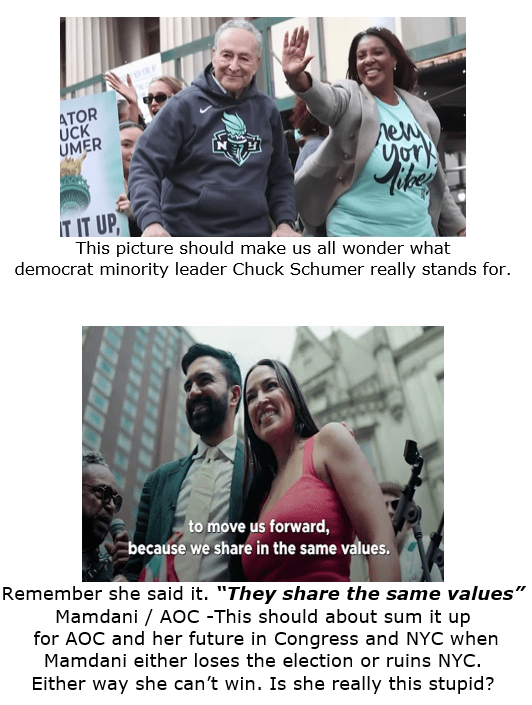

SOME PEOPLE JUST DON’T BELONG IN CONGRESS

This is what happens when you use a position of trust and honor to play an activist role. I have never seen anything so disrespectful in the house chambers before by any one individual. She is fighting for Palestine and her Muslim district who immigrated from Palestine. This is how she gains votes and stays in her position. It is the new game many of these newer democrats want to play. Just pay attention to “the squad”. Obviously, she is showing off for the cameras. Dumb people who don’t know any better buy into this crap. Oh…. so how many democrats have we watched being thrown out of hearings or public meetings? They are scared that they are next to go. No worries though, your just the small fry, the Grand Jury is in the process of going after the big fish first.

GRAND JURY INDICTS FORMER NATIONAL SECURITY ADVISOR JOHN BOLTON

Who’s next?

SUPREME COURT DROPS NIGHTMARE NEWS FOR DEMOCRATS

JUST BECAUSE THE SYMBOL OF YOUR POLITICAL PARTY IS A “jackass” DOES NOT MEAN YOU HAVE TO BE ONE.

Hee-Haw!

LETITA JAMES: Yes, “NO ONE IS ABOVE THE LAW”.

Now its time to live up to her own convictions. Yes, this time she is the hunted as “no one is above the law”, right? Only this time it’s not “fake charges”.

Why is Tish being indicted for her property on Peroni Ave, Virginia? Is there more to come? There are two other properties. All three of Tish’s properties have mortgage fraud over the last 42 years. It’s time to look closely at the other two properties. There will more than likely be more indictments coming for her. This is not a one time “mistake” or “oops” but a pattern over many years of intentional defrauding the mortgage companies and the banks.

We must keep in mind that this situation of Letita James is not about vengeance as it is more about justice. Just because it may appear that it is vengeance and in a way it is rightful vengeance, it does not mean we dismiss it. In her own words “no one is above the law”. Now the shoe is on the other foot.

If we have been following the biblical and prophetic side in the book of Samuel of what is happening to clean up our government, we can clearly see that Donald Trump had been picked by God to be his King David. Letita James is just one of many who were bent on stopping God’s work in the United States through Donald Trump. Whether you are a democrat or a republican the corruption is still very real and destroying our nation. I have to ask why the democrat party refuses to come onboard and help the republicans clean it up. Do they have something to hide?

God said through His prophets, that He hears our cries and He will bring justice to those that practice deceiving us.

LETITA JAMES: SHE’LL LOOK GOOD IN ORANGE.

This is necessary or the corruption will continue and even get worst.

LESSONS LEARNED? No, I guess not for democrats. This episode with Letitia James should be a reminder to all of us just how corrupt and dirty these people really are who get into govt offices and elected positions. But more importantly my question is this – How did Letitia James get away with this for so long? Why has no one researched her background before?

Is anyone vetting these candidates before they even run for office?

I know I have said this before but is this part of the problem too. Are we too relaxed in even choosing who will run and concentrate too much on the voting process when we have the opportunity to kick them out even before they get into office.

But there is more. And so who shares the same values? The corrupt seem to hang together. They support each other instead of learning from the mistakes of others. To tell you the truth I can’t figure out how people can be so dumb when it comes to politics. Do you really think sticking with losers is going to help your career?

COULD MEAN ‘DECADES IN PRISON’ – LETITIA JAMES PLEADS AFTER DOJ DISCOVERY

You made your bed, Letitia and now you have to lay in it! No you are not the victim, no this is not a racist thing. Good try… Can you believe people can actually be so stupid and conned into this? So, so sorry the election did not turn out like all you liberals wanted it to. Remember she ran on a platform to get Donald Trump and now she claims its “selective prosecution” that didn’t work and now it’s racism. Really?

Can I say “what goes around comes around” is the law of Karma?

ZOHRAN MAMDANI: WHAT’S HIS END GAME FOR NYC?

PAM BONDI STUNS DEMOCRATS

Pam Bondi STUNS Democrats with an unexpected move on Capitol Hill, turning their own arguments against them in a fiery hearing. Meanwhile, Stephen Miller dismantles CNN’s narrative in a viral interview that leaves the network scrambling.

HILLARY CLINTON’S BENGHAZI COVER-UP COMING TO FORFRONT AGAIN

Yes, Connecticut Senator Richard Blumenthal and Barrack Obama are also part of this cover-up. Blumenthal, the same guy who was governor of Connecticut for a short time and used the position to get his senate seat. Nearly a third of all emails on Hillary’s private server came from Blumenthal not about “family matters” as she claimed. He was also on the Clinton Foundation payroll for nearly $10,000 per month while pursuing his own interest in the middle east. Is this even legal? The French president too is implicated here in a shady arms deal with Libya and dark money that went to influence the French politics in president Nicolas Sarkoz’s presidential campaign. Blumenthal and Clinton were right in the middle of it. Of Course they had to use a private server. This was all illegal and corrupt.

Of course, Sarkoz was convicted and sat in jail already for years because of it. But two of the other perpetrators still walk the streets. Talk about Russian collusion? We have French collusion right under our noses. For a change, let’s talk real collusion not made-up stuff.

Can you also see now how the Clintons used their foundation money outside of the real “legal” intend of the foundation and that also is a crime.

Can you see now why they wanted the Comey FBI coverup of the laptop? They all protect each other.

Senator Blumenthal also lied about his military service. This guy is bad and I mean really bad! Please listen to the video and you will find out why the Clinton scandals will implicate many others along with her along the way. This is why they tried to wash the “lap top” scandal under the rug. But they are not going to succeed.

Anyhow, let’s concentrate too on what happened in Benghazi that day and why the lies had to be told about it to cover it up. But who will pay the price for this corruption? Will anyone actually be indicted for these crimes?

LETITIA JAMES PATH TO PRISON

Federal defense attorney Ronald Chapman unpacks the explosive grand jury investigation into James, including mortgage fraud allegations, civil rights violations, and DOJ subpoenas that could carry decades in prison time.

FORMER FBI DIRECTOR JAMES COMEY’S PATH TO PRISON

Who will he take along with him? Who’s next?

Attorney Ron Chapman. I like this guy. His news is nonbiased and nonpolitical. He tells it like it is. If a crime has been committed someone or some folks must pay the price for it. Folks this is not just Congressional hearings anymore. That is mostly all done already. Comey has been charged, or indicted, for crimes and more are coming. The investigation is not yet over.

A million-dollar dossier, a Phoenix tarmac meeting, and a former FBI Director now under federal indictment. What was once billed as “Russian interference” has exploded into a far-reaching scandal involving leaks, cover-ups, and political favoritism at the highest levels of government. From Hillary Clinton’s deleted emails and the Clinton Foundation probe to James Comey’s sworn denials before Congress, the case now charging him under 18 U.S.C. §§ 1001 and 1505 is only the beginning.

TIME IS UP FOR HILLARY CLINTON

Most true Americans just want justice and its way overdue. Who will the fall of Hillary take down with her? What is the Epstein connection in all this? Can it eventually lead to the take down Barrack Obama too?

Attorney Ron Chapman. I like this guy. His news is nonbiased and nonpolitical. He tells it like it is. If a crime has been committed someone or some folks must pay the price for it. Folks this is not just Congressional hearings anymore. This is the real thing. Comey will inevitably testify against Hillary to save his own ass. Besides there is more than enough evidence to put her in prison without it anyway.

TRUMP AGAIN ANNOUNCES POSSIBLE $1,000-$2,000 TARIFF DIVIDEND FOR TAX PAYING AMERICANS! TRUE OR FALSE?

WASHINGTON — President Trump has once again mentioned his idea of sending out stimulus checks to Americans. In an interview with One America News Thursday, he was asked what he would do with the revenues from higher tariffs on imported goods.

Trump first said they’re looking at “paying down debt.” He then added they also may issue a stimulus as a result. You can hear it from his own mouth. This is his words not mine. No rumors or opinions here.

In this interview he does not say this dividend is approved as it will have to come through congress and the senate first for appropriations. Let’s see what happens. If it does, it will probably not come until tariffs are working for a bit of time. So don’t expect it this year.

FROM “WE WANT IRAQ’S OIL” TO “MANAGE IT WELL”.. TRUMP’S WARNING OPENS THE DOOR TO AMERICAN INFLUENCE WITH A NEW FORMULA

American warnings about the future of Iraqi oil are renewed with US President Donald Trump’s recent statements, which re-shed light on how Iraq’s oil wealth is managed, amid widespread controversy over corruption, declining economic diversification, and continued reliance on rent (oil) as a basic pillar of the general budget.

Financial and economic expert Saleh Rashid pointed out that US President Donald Trump’s warnings about Iraqi oil “revealed important facts that Baghdad must take into account”, stressing the need to develop a comprehensive national strategy to invest oil wealth and strengthen the national economy.

Rashid said in an interview with Baghdad Today, “Trump pointed out that Iraq possesses huge quantities of oil, but it needs effective management. This shows that Iraq, despite its huge reserves and high production capacity, has relied mainly on government employment after 2003 and until now, as the majority of oil revenues are consumed as operating expenses and a very limited space is allocated to the investment dimension.” This has turned the national economy into an undiversified rentier economy and makes the country vulnerable to fluctuations in oil prices and the inability to benefit from non-oil revenues.

(Yes, Iraq needs to turnover these government jobs to the private sector and let them pay the salaries and benefits. Maybe they can eliminate this huge monthly “salary” bill they have to pay each month, which by the way is the controversy and contention as it is almost always late. This was leftover from the socialist Saddam Hussien era. This is also what the democrats want to do to the US and they want a huge government and expanded govt employees. They dream in a fantasy world and we can use Iraq as yet another example that socialism does not work. Why can’t they learn from it?)

He added, “The rampant corruption and elites involved in plundering public funds have transferred a large portion of wealth to the pockets of parties and their economic wings instead of strengthening the economy and improving services,” indicating that “continuing to manage the economy in this way without a national strategy will put Iraq before major challenges with any instability in the oil markets, increase pressure on the budget, and affect the financing of salaries and operating expenses.”

(Oh boy, haven’t we seen this too in the US?)

Rashid stressed that “oil must transform from a source of spending into a lever for development, and that investment and improving public services must be a priority for the next government, otherwise the country will face a catastrophic situation”.

Trump’s recent remarks at the Sharm el-Sheikh summit come years after his previous controversial remarks when he explicitly said, “We want to control Iraq’s oil.” However, the American language today has changed from demanding control to testing management.

In light of the American–Chinese competition over major Iraqi fields such as Rumaila and West Qurna, Washington seeks to reposition itself through what is known as the policy of “conditional governance”; That is, linking investment and support to the extent of Iraq’s efficiency in managing its resources, combating corruption, and improving the energy and investment environment.

Observers believe that the recent US warning is not only about oil as a commodity, but also as a tool to measure influence between Washington and Beijing inside Iraq. As Chinese companies expand their presence in the South, the US administration is working to establish new rules of the game: whoever does not manage oil well will face the problem that Trump warned about.

*************************************************************************************

BAGHDAD CONFIRMS ITS COMMITMENT TO THE ECONOMIC AND FINANCIAL REFORM PROGRAM

Prime Minister Saleh Mahoud Salman’s advisor confirmed on Friday that the government is continuing to implement comprehensive strategic banking reforms, noting that the government is committed to continuing to implement the economic and financial reform program.

Mahoud said in a speech he delivered during his participation as a government representative in the banking reform conference organized by the Central Bank of Iraq in cooperation with the international consulting firm (Oliver and Ayman) at the Ritz Carlton Hotel in Washington, DC, on the sidelines of the meetings of the International Monetary Fund and the World Bank: “The government is committed to continuing to implement the economic and financial reform program aimed at enhancing the efficiency of the banking system and supporting sustainable development in the country.”

He stressed that “the banking sector represents a fundamental pillar in the economic reform process,” indicating that “the government is continuing to implement comprehensive strategic banking reforms in cooperation with the Central Bank of Iraq, aimed at raising banking standards and enhancing the competitiveness of the financial system.”

He explained that “the government has prepared a three-year general budget for the first time, which allows for long-term financial planning, achieving stability in resource management, and enhancing the confidence of local and international investors.”

In the context of diversifying revenues and reducing dependence on oil, he explained that “the government has achieved tangible progress in automating the customs system by implementing the United Nations (ASYCUDA) system, which has led to a clear increase in customs revenues in addition to a significant improvement in tax revenues,” noting that “the government has implemented a program to restructure government banks (Al-Rafidain, Al-Rasheed, Industrial, and Agricultural) in cooperation with international consulting companies, With the aim of raising its efficiency and enhancing its ability to provide modern financial services.

He pointed out that “the government launched programs to expand the use of electronic payment and partnerships with financial technology companies, which contributed to raising the financial inclusion rate to more than 40% after it was less than 10% two years ago, which was praised by the World Bank and the International Monetary Fund,” stressing “the government’s support for small and medium enterprises by providing financing and resources to create new job opportunities and stimulate the local economy.”

Salman stated that “the banking reforms currently being worked on constitute a turning point in the history of Iraq’s economic development, and that the government is determined to support all local and international institutions working to develop the banking sector, as it is a pivotal part of the economic growth and financial stability plan.”

He noted that “the government extended its appreciation to the Central Bank, banks, and international and local advisory teams working in this field”.

***********************************************************************************************

CBI LAUNCHES FULL IMPLEMENTATION OF COMPREHENSIVE BANKING REFORM PROJECT

Advisor to the Iraqi Private Banks League/ Samir Al-Nusairi-

Samir Al-Nusairi, Advisor to the Iraqi Private Banks League, said that the measures and efforts undertaken by the Central Bank of Iraq (CBI), in coordination and consultation with private banks, have yielded tangible results in initiating the implementation of the goals, programs, mechanisms, and standards of the Comprehensive Banking Reform Project.

The initiative, carried out in cooperation with the government and the global consultancy firm Oliver Wyman as part of the CBI’s third strategic plan, aims to build a sound, modern, inclusive, and flexible banking sector capable of supporting rapid national economic growth, increasing the gross domestic product (GDP), and boosting the market value of Iraq’s banking industry.

Al-Nusairi emphasized that economic reform begins with banking reform, noting that Iraq’s economic challenges present opportunities for transformation within the financial and banking sectors. He highlighted that the government’s economic agenda and the Central Bank’s long-term vision both center on strengthening the role of the banking sector in achieving sustainable development, stimulating investment, and revitalizing non-oil productive sectors to diversify national income sources and ensure financial sustainability.

He added that the Central Bank’s ongoing efforts to organize foreign trade financing, complete infrastructure projects to achieve full digital transformation, and expand the use of electronic payment tools are essential to advancing financial inclusion.

According to Al-Nusairi, these initiatives will contribute to reforming, developing, and empowering the private banking sector between 2025 and 2028 through the following priorities:

1- Developing the Iraqi banking system to ensure full compliance with international banking and accounting standards.

2- Building a sound, modern, inclusive, and flexible banking sector.

3- Enhancing public confidence in the domestic banking system while achieving international recognition for transparency, progress, and strict adherence to global standards—thus earning the trust of reputable correspondent banks.

4- Rehabilitating underperforming and restricted banks to restore their full participation in domestic and international financial activities.

5- Redirecting banks toward their core function of financing and lending for development, while expanding financial inclusion and increasing participation rates as planned.

6- Advancing the transition from a cash-based to a digital economy by drawing an estimated 80% of money currently circulating outside the banking system into formal financial channels.

Al-Nusairi noted that although the reform project and the CBI’s strategic framework allocate three years for implementation, the progress achieved between 2023 and June 30, 2025, has already established solid foundations and mechanisms for the intended reforms. He added that these results represent ambitious performance indicators and will form the basis for evaluating and classifying banks according to their success in meeting the reform objectives, based on internationally recognized standards and benchmarks.

(What? Solid foundation for intended reforms? These were the reforms…What did we just experience in the last three years 2023-2025?)

************************************************************************************************

US REPORT: BANKING REFORMS IN IRAQ USHER IN A NEW ERA OF ECONOMIC GROWTH

A report issued by the American auditing and financial consulting firm Oliver Wyman on Friday confirmed that banking reforms in Iraq are ushering in a new era of economic growth.

The company said in its report, which was monitored by the Iraqi News Agency (INA), that “Iraq is entering a new phase of dynamic growth and economic opportunities thanks to comprehensive banking reforms led by the Central Bank of Iraq with government support.”

The report, which was presented at the Ritter Hotel in Washington, DC, indicated that “the banking sector reform program launched in April 2025 represents a fundamental shift towards building a more efficient and sustainable banking sector, capable of stimulating investment, developing the private sector, and strengthening international financial connectivity.”

The detailed presentation was attended by representatives of the US Treasury, the US Federal Reserve, and GP Morgan, as well as several regional and international banks.

Oliver Wyman stated that “the commitment of all Iraqi banks to the reform program starting in September 2025 will allow the Central Bank to evaluate their performance during the period 2026–2028 according to modern global financial, regulatory, and technological standards, enhancing trust and transparency and qualifying them to attract international institutional investors.

” Oliver Wyman expects that “the size of the Iraqi banking sector will reach more than $60 billion by 2035, with returns ranging between 15 and 20%,” considering that “addressing current challenges such as reputation and governance will make the reforms a unique investment opportunity in the Middle East and North Africa region.”

***********************************************************************************************

IRAQ, UNITED STATES US TREASURY ADJUSTS TO WEAKER INTELLIGENCE PICTURE AFTER BANKING CHANGES IN IRAQ

The end of Iraq’s old Federal Reserve-linked dollar system did much to combat Iranian financing. But it also removed key financial intelligence streams which the US Treasury were using to identify hostile elements in the country.

The US Treasury is closely monitoring new anti-laundering and terrorist financing procedures in Iraq’s banking sector following a multi-year redesign of its dollar payment system, Intelligence Online understands.

The Trump government has backed efforts, already underway under the previous administration, to transition Iraq away from its reliance on the New York Federal Reserve towards a correspondent banking model for dollar transactions. But the emerging system, in which international wires are executed via the Brussels-headquartered SWIFT communications system, has left the Treasury with less visibility on financial flows from Baghdad.

A person with detailed knowledge of the matter said nervousness over the reduced intelligence picture was among reasons why it took the US government so long to shut the old system down. “It was useful to the Treasury because it told them where the money was going”, the former official said.

UNIQUE ROLE

In the aftermath of the US invasion of Iraq in 2003, a unique system was created in which the Federal Reserve played a central role processing Iraq-origin dollar payments. The Fed facilitated international wires by sending dollar currency from Iraq’s US-based accounts to overseas bank accounts as per instructions from the Central Bank of Iraq (CBI). In parallel, it also delivered pallets of the currency, earned from Iraq’s vital oil industry, to the CBI to facilitate local dollar usage – the so-called “auction” system.

Biden era-officials including Wally Adeyemo began coordinating the shift away from the system in around 2023, when the US barred more than two dozen banks from accessing dollars. Iraqi officials, told to combat funding for Iran-linked militias in the country, appointed a group of US compliance consultancies to help improve financial risk monitoring at local lenders (IO, 21/10/24). It is the first step in a long-term project to establish correspondent banking partnerships with American institutions.

But sources said the old overseas dollar wiring system, though opaque, provided the Federal Reserve and US Treasury with a more immediate picture of illicit financing streams. Customers wishing to make dollar wires internationally sent specific account information to the CBI, which relayed it to the Fed for execution. The recipient accounts might only be a link in an onward chain but provided Washington with useful information on financing routes.

Now, in the case of the several Iraqi lenders linked up to US correspondents, the Treasury accesses Iraq-origin dollar transfer records by issuing administrative subpoenas to SWIFT. The intelligence transfers occur rapidly under the aegis of a 2010 EU-US deal on data handling, but are limited to certain categories of wires. Law enforcement also relies on reporting from the US intermediaries.

CAPACITY BUILDING

Those Iraqi lenders now holding correspondent relationships include the state-owned Trade Bank of Iraq and smaller private lender Bank of Baghdad, Intelligence Online understands. Rafidain Bank and First Iraqi Bank are hoping to follow in due course. Separately K2 Integrity, the compliance and investigations consultancy, has also been working with an electronic payments platform, Qi, according to a June press release, which is part-owned by Rafidain Bank and Al-Rasheed Bank.

Last year, the Wall Street Journal reported that US officials had been warning the CBI about abuse of the dollar system since 2012. In one example, the Treasury had tracked dollar requests made to the Fed by three banks – Iraqi Middle East Investment Bank, Al Ansari Islamic Bank and Al Qabidh Islamic Bank – which led to $3.5bn being sent to companies in the UAE linked to Iranian financing.

The changes come at a crucial time for Iraq, with the US announcing a significant reduction in troops in the country on 30 September, just ahead of parliamentary elections in November. Those in turn will lead to appointment of a prime minister, expected to be the incumbent, Mohammed Shia al-Sudani, who came to power with the help of Tehran-aligned forces in the country but has since proven to be a pragmatist, balancing loyalties towards both Tehran and Washington.

************************************************************************************************

AL-SUDANI FLIRTS WITH TRUMP AND WOOS BLAIR: A GREAT FRIEND OF THE IRAQIS

Iraqi Prime Minister Mohammed Shia al-Sudani affirmed his support for US President Donald Trump’s Gaza peace agreement on Monday, while also highlighting Iraq’s rejection of normalization.

Al-Sudani said in an interview with the American network ” CNBC “, translated by Shafaq News Agency, that “the United States confirms, through communication and messages, the strength of relations with Baghdad, which supports the US administration’s efforts for peace in the region, but at the same time, with regard to the possibility of normalization with Israel, it is committed to the laws enacted by the Iraqi Parliament.”

Regarding US President Donald Trump’s plan for a ceasefire in Gaza, he affirmed, “Iraq has declared its support for the agreement reached by President Trump, and we believe he is serious about achieving peace, and that is everyone’s goal.”

He explained that “since the events of October 7, 2023, Iraq’s position has been clear: to stop the war and adopt dialogue as the basis for resolving these disputes and conflicts. However, the Palestinian issue is the core of the problem in the Middle East, and the time has come to find solutions through dialogue and respect for international institutions and treaties.”

**************************************************************************************************

FROM WASHINGTON: A NEW BANKING AND ECONOMIC REFORM PACKAGE FOR IRAQ

The Iraqi delegation participating in the banking reform conference in Washington, D.C., on the sidelines of the International Monetary Fund and World Bank meetings, announced a new package of banking and economic reforms on Saturday aimed at strengthening the stability of the financial system and attracting investment.

“The government has implemented a series of steps as part of the economic and financial reform program, most notably the implementation of comprehensive strategic banking reforms in cooperation with the Central Bank of Iraq and international consulting firms, as well as the preparation of a three-year budget for the first time in Iraq’s history to ensure stable financial planning that attracts investment,” said Saleh Mahoud Salman, an advisor to the Iraqi Prime Minister, according to a statement received by Shafaq News Agency.

He added that “automating the customs system through the implementation of the United Nations ASYCUDA program has led to a significant increase in customs and tax revenues, the restructuring of government banks (Rafidain, Rasheed, Industrial, and Agricultural) and increased their operational efficiency, as well as the expansion of electronic payment systems and increased financial inclusion from less than 10% to more than 40% within two years.”

Salman continued, “Support programs have been launched for small and medium-sized enterprises to create job opportunities and stimulate the local economy,” noting that “these steps represent a pivotal stage in the economic reform process, and that the government will continue to support the development of the banking sector in cooperation with international institutions.”

Prior to this, the Central Bank of Iraq announced new instructions to all authorized banks in the country regarding money transfers and customs clearance procedures related to the requirements for the approval of special commercial invoices, with the aim of curbing currency smuggling. This measure comes as part of the efforts of the Central Bank of Iraq and government agencies to develop the financial and administrative environment and improve the level of oversight and compliance with international standards in foreign trade.

(Hey, what about currency reform? Did you forget about this? The CBI recently told us this did not forget about it and are committed to doing it.)

************************************************************************************************

PRIME MINISTER’S ADVISOR: IRAQ IS EXPERIENCING ITS MOST STABLE PERIOD THANKS TO STRONG FOREIGN RESERVES.

The Prime Minister’s advisor for financial affairs, Mazhar Mohammed Salih, issued a clarification on Sunday regarding Iraq’s internal and external debt. While noting that domestic borrowing represents only 18 percent of the total precautionary debt, he confirmed the existence of committees working with international companies to convert a portion of the domestic debt into investment vehicles.

Saleh told the Iraqi News Agency (INA): “There is a blurry picture in interpreting the issue of external debt, as the external debts due until 2028 do not exceed $9 billion, which constitutes mostly half of the country’s total external debt,” indicating that “there are coordinated repayment mechanisms between the Ministry of Finance and the Central Bank, which are highly governed and transparent, and are settled accurately within a strict program and allocations in the federal general budget, and are periodically extinguished with the international creditor community.”

He added, “The total external debt does not exceed what was mentioned above, and the amounts mentioned in the Central Bank’s letter require explanation, as Iraq is not obligated to pay them, especially the $41 billion, as they are subject to the Paris Club agreement of 2004, which wrote off 80% or more of those debts related to the Iran-Iraq war, or what are called pre-1990 debts.”

He continued, “As for the domestic debt referred to in the Central Bank’s letter, it is the result of the accumulation of financial, security, financial and health crises that the Iraqi economy has been exposed to over the past decade and since the war on ISIS terrorism. This has been accompanied in recent years by severe geopolitical factors that have exposed global oil markets to a decline in prices due to the decline in growth in the global economy.” He explained that “the borrowing undertaken by the current government as domestic debt constitutes only 18% of the total precautionary domestic debt included in the federal general budget (the three-year budget) pursuant to Law No. 13 of 2023 for the years 2023-2025.”

He stated that “the internal debt, which amounts to approximately 91 trillion dinars, is mostly held by the government banking system and under high-level financial and technical management,” noting that “there are specialized committees working in cooperation with international consulting companies to convert a large portion of that internal public debt into productive investment tools within a national fund to manage the aforementioned internal debt in a manner that aims to stimulate the real economy and transform debt obligations into investment opportunities in the real sector of the Iraqi economy.” He explained that “Iraq is currently experiencing the most stable period due to the strength of foreign reserves, the function of which is to stabilize the purchasing power of the Iraqi dinar and sustainable development.”

(Oops they said it again, “Iraq is currently experiencing the most stable period”. So where is the Project to Delete the Zeros?)

**************************************************************************************************

BETWEEN REFORM AND DICTATE, THE CENTRAL BANK LEADS BANKS TOWARD A FINANCIAL TRANSFORMATION WITH AN AMERICAN CHARACTER.

The Iraqi banking sector stands on the cusp of a new phase, where ambitions for reform intertwine with the complex reality of external pressures. This follows the release of a report by the American firm Oliver Wyman , which predicts that the size of the Iraqi banking sector will reach $60 billion by 2035.

(Folks I have to say that this is not that much however considering what Iraq has gone through, its population and size of their country, it is a hopeful sign that this can double in the near future and most likely will.)

Although this figure may seem ambitious, it reflects the magnitude of the stakes in the Central Bank of Iraq’s ability to lead a genuine banking transformation that restores confidence in the financial system. However, it also raises questions about the nature of this reform, and whether it is internally generated or externally imposed.

In this context, economic expert Abdul Hussein Al-Shammari told Al-Alam Al-Jadeed that Oliver Wyman’s forecasts seem reasonable given the accumulation of assets in Iraqi banks, but they do not necessarily mean real reform.

Al-Shammari explains that “the largest Iraqi banks have assets exceeding $40 billion, so reaching $60 billion is not surprising, but they have accumulated over two decades through massive government capital movements, not through productive banking activity.” He adds that “the Iraqi banking sector is witnessing what can be described as forced development, not as a result of local reforms, but rather as a result of direct ties to the American financial system.”

Oliver Wyman’s report expressed a highly optimistic tone, confirming that Iraq “is entering a new phase of growth thanks to comprehensive banking reforms led by the Central Bank with government support,” predicting that “the banking sector will reach more than $60 billion by 2035, with returns ranging between 15 and 20 percent.”

It’s worth noting that the Central Bank of Iraq announced last April a collaboration with Oliver Wyman to modernize the banking sector, achieve attractive and sustainable returns for shareholders, enhance the protection of depositors and creditors, expand the financial infrastructure, including an increased network of branches and ATMs, and simplify and assess compliance with anti-money laundering and counter-terrorism financing measures through a digital identity system.

On August 12, the bank’s governor, Ali Al-Alaq, discussed with the company the details of the banking reform plan submitted by the Iraqi Private Banks Association, as part of efforts to develop the banking sector and align it with international standards.

After decades of reliance on oil transfers and the accumulation of liquidity in government banks, the Iraqi sector remains vulnerable to any shift in US monetary policy, as nearly all transfers pass through the US federal system before being repatriated.

Although the Central Bank of Iraq speaks of a “comprehensive reform” plan, experts believe it was a response to US demands related to combating money laundering and controlling transfers, rather than a comprehensive national vision for developing the financial sector. This suggests that external pressures were the primary motivation for changing the banking structure, rather than competition or innovation related to developing the sector.

For his part, Alaa Al-Fahd, a member of the Central Bank of Iraq’s media team, confirmed to Al-Alam Al-Jadeed that “all banks have entered into the reform plan and expressed their willingness to change their plans and strategies, move from family ownership to investment partnerships, and implement the plan’s provisions, which include a shift towards a credit-based banking environment that encourages financial inclusion, combats money laundering, and adheres to international standards, as well as the implementation of modern electronic financial banking programs.”

Al-Fahd expects the plan to achieve its intended objectives, as banks have expressed their full readiness to implement the provisions comprehensively, including forming partnerships between local banks and external and foreign investors.

This transformation is part of the government’s program, the twelfth axis of which includes a clear clause on “financial and banking reform,” which aims to transform banks from deposit and withdrawal instruments into effective financing and investment institutions.

The first phase of the project began with the major government banks, Rafidain and Rashid, as models for structural and administrative transformation within the financial sector.

The plan also sets a central goal of “transforming from sole proprietorship to shared governance,” reducing the influence of commercial families that have controlled private banks for decades. This is expected to open the door to foreign capital and Arab investors entering the Iraqi market in the coming years.

For his part, economic expert Ahmed Abdel Rabbo told Al-Alam Al-Jadeed that “Oliver Wyman’s latest report is optimistic and reflects the seriousness of the Central Bank of Iraq in moving forward with reforming the financial system,” noting that “the next phase requires practical measures to support this approach.”

Abdul Rabbah adds, “The gradual lifting of sanctions on banks that have not been proven to be involved in money laundering operations will contribute to advancing financial reform and preparing the banking system for a new phase of stability and openness.”

These calls come amid a difficult reality, as more than 30 Iraqi banks are subject to US sanctions or restrictions due to suspicions of dollar smuggling and financing illicit activities.

Although some of these sanctions were described as “precautionary” or “temporary,” they undermined market confidence and forced Iraqi banks to rely on dealing in local or alternative currencies, reducing their external activity and impacting the flow of hard currency.

Reports indicate that most Iraqi banks still rely on government deposits and employee salaries, while lending to the private sector does not exceed 15 percent of total liquidity.

Moreover, citizens’ weak banking culture and lack of financial awareness limit the expansion of digital banking services, despite the Central Bank’s attempts to introduce financial inclusion and digital transformation programs.

Experts believe that international reports, despite their importance, do not always reflect the complex reality of the Iraqi market, where politics and finance intertwine, and banking procedures are often subject to the balance of power between Washington and Tehran rather than purely economic calculations.

According to experts, Iraqi banks’ commitment to the new reform plan will have a positive impact on the overall economic situation. Some banks have liquidity exceeding $10 billion but have yet to activate it, pending the completion of Oliver Wyman’s audits and the final confirmation of their legal and financial status.

Experts point out that releasing these funds will help stimulate investment and lending within the local market and restore confidence in the banking sector, which has been freezing a significant portion of its funds for fear of falling under sanctions or financial suspicion.

********************************************************************************************

THE PRIME MINISTER ANNOUNCES NEW MEASURES TO SUPPORT THE PRIVATE SECTOR.

(So many words to basically boast about Baghdad International Hospital, which is being implemented by the Qatari Investment Holding Company. Also the implementation of a health insurance law, and a pitch for the Development Road Project once again.)

Prime Minister Mohammed Shia al-Sudani announced on Sunday measures to support the private sector and create an attractive investment environment.

The Prime Minister’s Media Office said in a statement, “Prime Minister Mohammed Shia al-Sudani launched the implementation works of the Baghdad International Hospital, which is being implemented by the Qatari Investment Holding Company, today, Sunday.”

Al-Sudani, according to the statement, expressed his welcome to the brothers from the State of Qatar as they implement a large medical facility in Baghdad, which, along with previous projects, represents an image of cooperation between the two brotherly countries, recalling the visit of the Emir of the State of Qatar, Sheikh Tamim bin Hamad Al Thani, to Baghdad, during which he announced a package of projects with a financial ceiling ranging from (5-7) billion dollars in various fields.

The Prime Minister pointed out that “we are working resolutely to create an attractive investment environment by reducing red tape and addressing previous laws that hinder foreign investment, in addition to a package of government decisions and legislation.”

Al-Sudani praised “the efforts of the medical, administrative, and technical staff at the Ministry of Health, the National Investment Commission, and the Baghdad Municipality in completing the requirements for granting the investment license and signing the contract,” stressing that “this project will receive support, follow-up, and the necessary facilities from various relevant parties to implement it according to what was planned and designed and within the specified timeframes.”

Al-Sudani said, “We have opened the doors to distinguished companies with successful experiences, which we have found in the Qatar Investment Holding Company.” He emphasized, “Our government has taken measures to support the private sector and create an attractive environment for investments exceeding $102 billion.”

He continued, “Despite the region’s unnatural circumstances, the direction was clear toward investment in Iraq,” indicating, “We have a wealth of investment opportunities in various sectors, and they will be available to businessmen, investors, and companies.”

He pointed out that “the Development Road project represents another aspect of the investment opportunities being prepared by international consulting firms,” noting that “the health sector is among the government’s top priorities, which has achieved a qualitative shift in this sector through the implementation of the Health Insurance Law.”

He stated, “We have launched work on the pharmaceutical industrial city in partnership with American and British companies,” stressing, “We have worked on several tracks to advance the health sector in Baghdad, in terms of infrastructure and completing stalled projects.”

He continued, “We are moving towards establishing new hospitals with varying bed capacities in the districts, and establishing and rehabilitating specialized centers in Baghdad and the governorates.” He noted that “we have a package of facilities and guarantees for drug producers to advance the local pharmaceutical industry, which has witnessed an unprecedented leap over the past two years.”

He continued, “We have taken effective steps to implement the health insurance law, which covers 2.3 million citizens,” noting that “we have adopted a joint management and operation approach with reputable and well-known medical institutions to improve the quality of health, medical, and treatment services for citizens.”

**************************************************************************************************

IRAQ BOOSTS ITS GOLD RESERVES TO 162.5 TONS

Iraq continues to boost its gold reserves, with stored quantities increasing from 100 tons to 162.5 tons in recent years, according to an economic expert.

Expert Abdul Rahman Al-Mashhadani explained in a statement to Al-Furat News that: “Iraq continues to purchase gold to bolster its national reserves, although the quantities acquired remain limited compared to the ambitious plans to enhance financial stability.”

He pointed out that “increasing gold reserves represents an important step towards strengthening the national economy and supporting financial liquidity, as well as being a strategic safety factor in the face of global market volatility.”

********************************************************************************************

AL-GHARIRI: IRAQ’S NEGOTIATIONS TO JOIN THE WORLD TRADE ORGANIZATION ARE ONGOING.

Minister of Trade Athir Dawood Al-Ghurairi confirmed on Monday that Iraq’s negotiations to join the World Trade Organization are ongoing, while pointing out that regional cooperation and integration are the way to achieve peace, stability and sustainable development.

A statement by the Ministry of Trade received by the Iraqi News Agency (INA) stated that “Minister of Trade Athir Dawood Al-Ghurairi participated in the 16th session of the United Nations Conference on Trade and Development (UNCTAD), held in Geneva with the wide participation of representatives of countries and international and regional organizations.”

The minister stressed, according to the statement, that “collective action and regional integration represent a fundamental pillar for building a more stable and equitable economic system in light of the transformations and challenges witnessed by the world,” stressing that “open regional agreements can support the multilateral trading system and promote sustainable development.”

Al-Ghurairi indicated that “Iraq, which continues its negotiations to join the World Trade Organization, sees regional initiatives as an opportunity to enhance its institutional readiness and align its legislative and investment frameworks, enabling it to effectively integrate into the global economy.”

He explained that “regional integration represents a pillar for development and reconstruction, and that cooperation in the areas of infrastructure, simplifying customs procedures, encouraging investment, energy, agriculture, and services contributes to enhancing competitiveness and diversifying the national economy.”

At the end of his speech, the Minister praised UNCTAD’s significant role in supporting Iraq during its accession to the World Trade Organization, stressing that “regional cooperation and integration are the path to achieving peace, stability, and sustainable development.”

*********************************************************************************************

WASHINGTON SANCTIONS EXPOSE IRAQ’S SHADOW ECONOMY

In Iraq’s shadow economy, even compliance has become a racket.

Iranian rials, US dollars and Iraqi dinars are seen at a currency exchange shop in Basra, Iraq.

Just five days after I warned in my article, “The Dark Side of Iraq’s Economic Boom,” that Baghdad’s skyline was rising on a foundation of dirty money, Washington confirmed it. Before the announcement, a senior US official had told me privately: “The networks behind these projects are already on our radar, and the administration is prepared to act.” I knew what was coming. That private conversation made one thing clear:

enforcement was not a question of if, but when. Days later, it happened. On October 9, the US Treasury imposed sweeping sanctions on Iraq’s militia-linked business networks, exposing a financial web long hiding in plain sight. These sanctions did not just target individuals; they revealed an entire economic architecture built on militia finance, sanctioned capital and a shadow economy now embedded within the Iraqi state.

Over the past year, Iraq has presented the world with the image of renewal, a skyline rising, cranes crowding Baghdad’s horizon, and foreign investors testing the waters of a once-closed market. But beneath that narrative runs a different reality: an economy dominated by political patrons, militia financiers and networks tied to Iran’s Revolutionary Guard. Washington’s latest move exposes that reality and places Iraq squarely at the centre of a larger contest, the financial front in Washington’s campaign to dismantle Tehran’s proxy networks.

Iraq is no longer merely influenced by militias, it is being run like one. A silent merger has taken place between the state and its shadows, where ministries award contracts to frontmen and banks launder millions for Iran’s most dangerous proxies. Entire sectors, from construction to commerce, fuel the militia economy. The US Treasury’s latest sanctions offer a rare X-ray: an economy rewired for corruption, powered by militia capital and cloaked in the language of reconstruction. What began as insurgency has become infrastructure.

Iran’s proxies have learned that cement and steel can do what rockets never could: embed themselves within the machinery of the Iraqi state. And their reach does not stop at government contracts or construction sites. It stretches into hotels, restaurants, cafés, fast food outlets, fashion outlets, retail businesses and Western franchises, businesses that appear ordinary, but often serve as fronts for laundering money, building influence, and normalizing control.

According to the Treasury statement: “The Iranian regime relies on various Iraqi militia proxies, including US-sanctioned foreign terrorist organization Katai’b Hezbollah, to penetrate Iraq’s security forces and economy.

“These Iran-backed groups are not only responsible for the deaths of US personnel but also conduct attacks against US interests and those of our allies across the Middle East.

“The militias actively undermine the Iraqi economy, monopolizing resources through graft and corruption, and hinder the formation of a functioning Iraqi government that would make the region safer.”

The Treasury identified specific commanders accused of intelligence gathering for Iran, including Hasan Qahtan Al-Sa’idi and his son Muhammad Qahtan Al-Sa’idi, as well as Haytham Sabih Sa’id: “Commanders from Kataib Hezbollah and the IRGC coordinated operations targeting US interests in Iraq earlier this year.”

Deputy State Department spokesman Tommy Pigott summed up the sanctions rationale on X (Twitter): “The United States is pursuing maximum pressure on Iran. We are targeting the IRGC-Qods Force, which supports Iran’s regional terrorist partners and proxies, and two Iraq-based groups, Katai’b Hezbollah and Asaib Ahl al-Haq. These militias actively undermine Iraq’s sovereignty, weaken Iraq’s economy, and conduct attacks against US personnel and interests across the Middle East.”

In a related post, Congressman Joe Wilson urged further sanctions: “Iraq must be freed from Iran’s grip.”

Treasury’s October 9 designations now also provide documentary proof of that pattern. Muhandis General Company’s “undisclosed real-estate projects,” cited in the sanctions release, mirror the very examples outlined in my earlier reporting, projects that international hotel groups quietly rejected over reputational concerns.

Among those named in Washington’s latest round were Katai’b Hezbollah’s commercial arm, Muhandis General Company, and its agricultural front, Baladna Investments, both accused of diverting Iraqi government contracts, laundering funds and supporting weapons smuggling under the guise of reconstruction. The Treasury also sanctioned Aqeel Meften, head of Iraq’s National Olympic Committee and his brother Ali Meften, for using a commercial bank to move money for the IRGC’s Quds Force.

“For decades, the Meften brothers have laundered tens of millions of dollars for Iran, and smuggled oil and drugs and abused Aqeel Meften’s position as president of Iraq’s National Olympic Committee to engage in corruption.” the Treasury Department said.