from September 2003 to October 2012.

I wanted to write this page to clarify the Dr Shababi / IMF plan for reinstatement of the Iraqi dinar. I know I talk about it often in many of my Mnt Goat Newsletters. Note I did not say “revalue” but instead “reinstatement” (or liberate) as this is the end game to his plan. It is much more complicated than you think, and I have to include all the events along the way since 2003 to tell his story and expose his plan.

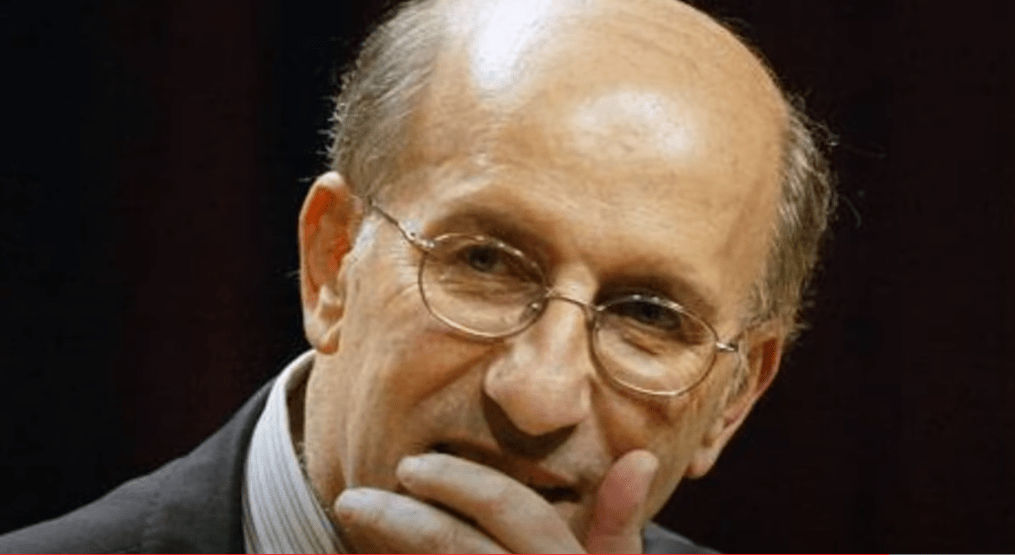

Dr. Sinan Al-Shabibi, a brilliant economist who served as the governor of the Central Bank of Iraq from September 2003 to October 2012. In April of 2011 he met with the International Monetary Fund (IMF) and helped devise a workable strategy that would eventually lead to the liberation of the Iraq dinar. I am going to summarize these steps of the plan of this mastermind economist for you today.

In 2012 Dr Shabib was well on his way to accomplishing his plan of liberation of the dinar, until it was halted, intentionally I might add, by the corrupt prime minister Nori Al-Maliki at that time. Actually, it was the President Obama administration that really stopped it, with the help of Maliki. The then prime minister, Al-Maliki under the direction of President Obama, orchestrated a plan to falsely accuse the Central Bank of Iraq (CBI) governor of corruption and money laundering. It was a well-planned, orchestrated scheme that resulting in not allowing the Project to Delete the Zeros in the fall of 2012 and thus also halted the Reinstatement in early 2013 that was to follow.

In the summer of 2012, I can remember all the news articles by the CBI and economist talking about the upcoming Project the Delete the Zeros, a mandatory precursor to any significant change in the rate of the dinar. I will let you review in more detail this project on your own by clicking on the link above.

In this all telling video we got a good perspective as to the plan of Dr. Shabibi and the obstacles holding up the reinstatement.

Here are the three (3) basic steps to his plan.

- Conduct the project to delete the zeros

- Monitor for inflation

- Reinstate the IQD back to the currency exchanges namely FOREX

Here is a summary of events along the way for his plan:

- Be able to track inflation and reduce it to no more than 2%

- Reduce the note count of the monetary mass by almost half (this will be allowed by electronic banking including Point of Sale, debit cards, govt payment cards, etc.)

- Flush out/recover 90% of the monetary mass hard cash notes stashed outside of the banking sector

- Monitor the parallel market US Dollar vs Iraqi dinar to Central Bank Official rate. Attempt to match both markets

- Establish a close match between the parallel market rate and the CBI official rate for the dollar (+ or – 2%).

- Bring and hold the CBI reserves to an acceptable level to sustain the Iraqi economy in market downturns of oil revenues. IMF requires at least 45 billion to be considered stable.

- Inflation and price stability then determine the exchange rate movement

- Ability to pay govt salaries on time and in full on a reoccurring basis (most holdups were from the delay in the US sending funds to Iraq from the DFI fund. Closing these accounts and the transfer of the management of these funds back to Iraq will resolve this issue)

- Work with IMF to find a suitable permanent peg for the currency, a basket of currencies to which to re-peg the dinar. This will create a higher level of price stability in times of market decline (meaning decline in oil revenues)

- Allow the dinar to float outside the sole De Facto peg to the US Dollar

- Renominate the dinar by conducting the Project to Delete the Zeros, issue the newer lower denominations

- For a period, monitor closely for inflation until price stability is reached, keep inflation low

- Reinstate the dinar to FOREX, use a managed float, re-peg to a basket of currencies (To be determined)

NOTE- VERY IMPORTANT

I want to emphasize that the Dr Shabibi plan of 2011 does not elaborate or even mention rebuilding of the Iraqi economy to a sustainable level prior to conducting the reinstatement. This new criterion came during the president Obama era and drastically changed the process to where we are today. It prolonged the process, and some say was even detrimental to Iraq in the long run.

Instead, working in accordance with the president G.W. Bush’s policies, the brilliant Dr Shabibi trusted his expertise in economics and finance and knew that the liberation of the dinar would take care of many of these other issues that we have seen crop up with the corruption that could have been avoided, had his timing of the reinstatement been successful.

He used to even make the same comparison that I make in my Newsletter as – “what comes first the chicken or the egg”. Of course, in applying this to Iraq I cannot take full credit as he owns this saying. As a researcher of the TRUTH, I have to conclude that it was the corrupt plan by Obama to allow this massive corruption scheme of stealing the Iraqi wealth to support Iran through his actions in preventing the reinstatement in 2013. We must also think about whether Obama is actually a radical Muslim and supports the terrorist organizations of Iran and use them to his means.

I will next try to address each of these items in detail so you can see over the last 13 years (2012-2025) and how events such as the new Obama criterion for Iraq has affected this Dr Shabibi plan implementation. I then want to look at the new president Trump era and his foreign policy towards Iraq.

Could this be why we investors have waited so long for the RV, to get an American champion to fight for Iraq (such as Trump) to put in place realistic and common sense back to handling Iraq as a sovereign nation again instead of using it as a grounds for corruption. Now it is late 2025 and we find that Iraq is now quickly making headway and coming fully out of sanctions in whole and soon back to a nominal rate, a rate of the IQD reflecting the actual economy and assets of the country.

Obtain secondly Price Stability– FYI we are talking about the rate of the Iraqi dinar and US dollar not the price of goods on the shelves in the stores. This is accomplished by matching the parallel market rate of the dinar to the official CBI rate of the dinar. Remember that Iraq was forced to use the US Dollar to pay for all imports since the IQD was ripped off of FOREX and the other currency exchanges in 2003 due to the war and the possible use of the currency to fund terrorism. Then in October of 2004 the larger 3 zero notes replaced the Saddam Hussein notes. The plan was to switch them back and redenominate in five years meaning around 2008-2009 to a newer set of lower denomination notes without the Saddam Hussien picture on them. So, today twenty years later we still see Iraq using the three zero notes of 2004. Why is this. Now knowing the plan doesn’t this seem a bit weird to you.

This is because of the rapid corruption within Iraq that soon prevailed in the currency auctions used to purchase US Dollars with the three zero notes in order to pay for imports. This was a constant drain of US Dollars (oil revenues) from Iraq to Iran through the currency auctions to fund terrorism. Yes, this process resulted in just the opposite to which it was intended to prevent. So, in 2011 Dr Shabibi knew it was imperative to get out of the currency auction process and liberate the dinar so it could become the national currency, have value and be used to pay for trade. As you may know they call Iraq the “rentier” economy as it receives oil revenues in US dollars only (petrol-dollars) and then uses these dollars to pay for imports. Iraq today survives mostly on imports which makes up about 90-95% of their economy. The future goal is to develop their economy to produce more products in-country by attracting foreign investors to set up shop in Iraq to manufacture and sell their products with enough to export. Iraq needs to diversify its economy from the rentier economy. This is all within the UN / Obama era goals of sustainability in times of crisis.

Tracking Inflation is most important: So, today twenty years later Iraq still struggles with inflation. Inflation stems from the inability of the CBI to control the official rate of the dollar and thus control inflation. If it costs more to purchase dollars to pay for Iraqi imports than your “cost of goods sold” increases thus you reflect (or pass on) this increase in the prices to your consumers on the store shelves. Remember that when I use the term of controlling the dollar it is also reflected in the rate of the dinar as the dinar is solely pegged to the US Dollar. Yes, pegged only the US Dollar and this was decided in 2004. This is called a “de facto” peg. It is a typical “temporary” like peg used by the IMF in situations like with Iraq. But again, it is supposed to be temporary. This is De Facto peg is now part of the problem not the solution.

Inflation Rising -In 2014 the war with ISIS infiltrated into Iraq. How did this happen? My guess is that the corrupt prime minister Nori Al-Maliki, then trying for a third term as prime minister, was going to use ISIS as an excuse to call for Martial Law, to which he almost succeeded if not for the Iraqi constitution and parliament standing its ground to prevent it. Then an already stretched economy of Iraq having to pay for the war with ISIS was hit with the Covid pandemic. Remember too that Iraq was already paying billions each year to Kuwait for war reparations. As a result of Covid, oil prices plummeted as industry shut down across the globe. Being a “rentier” economy, the CBI reserves also plummeted as these funds were then used to prop up the economy in time of lesser incoming oil revenues. This caused the CBI to devalue the dinar to boost the CBI reserves back to sustainable levels. This plan was successful in just two years. But the devaluation caused inflation, something Iraq struggles with even today. But they are controlling it. When the cost of buying the US Dollar goes up to pay for imports, the price of this extra is reflected in the cost of the product in the stores. There was also a supply and demand situation. The supply of items were scarce and thus prices rose. So Iraq got hit with two serious factors affecting inflation.

Time to move aggressively forward: Then in 2022, after all war reparations were paid to Kuwait, as specified by the sanctions, all Chapter VII UN sanctions were finally lifted from Iraq. This freed up billions of oil revenues that could now go towards rebuilding the economy and war torn Iraq. This allowed a revaluation of the dinar to the official rate of 1320 from 1450, which is where it remains today. So, the battles continue to win back the full sovereignty of Iraq and of course part of this is to liberate its currency. Words are just merely words and actions today are making rapid progress to depict real tangible progress in this effort for the currency. Millions of investors in the Iraqi dinar keep asking what is the holdup of the revaluation? I have to say NOTHING, absolutely NOTHING. As the dinar did revalue in December of 2022 from 1450 to the official rate of 1320 already. So there’s one revaluation that most discount. But its not what we investors are looking for. Also the US and Europe banks need to catch up too since it is hard to exchange the dinar as it still is valued at 1/6 of a penny. Most banks are still afraid to touch it since there are still US Treasury OFAC sanctions on the dinar.

The US Treasury Office of Foreign Assets Control (OFAC) administers and enforces economic sanctions programs primarily against countries and groups of individuals, such as terrorists and narcotics traffickers. So, when will these sanctions be lifted on the Iraqi dinar, since they have been fully out of Chapter VII UN sanctions now for way over a year.

We are told by the Central Bank of Iraq that the dinar is about to revalue once again if they can get the price stability they need. But is this what we are looking for as investors in this currency anyhow? So, logically we can surmise that these revaluations and devaluations since 2003, while still in the program rate De Facto peg, are not our full concern other than to watch the progress of the process of the Dr Shabibi plan moving ahead to someday liberate the dinar back to it’s true value. Its real nominal value. Yes, a true value if even reflecting in the value of the dinar under the “rentier” economy and then let it rise while on a managed float on FOREX, while Iraq’s economy grows. But his is no longer in the Obama era plan they are now following. It will take more than smart economists to reason why the Dr Shabibi plan would not work and why they had to move to a new Obama plan. It will take some major moves by smart Iraqi politicians to end the corruption in the dinar not only from inside Iraq (currency auctions) but also in the outside political suppression of Iraq by external forces.

We read about the “White Paper” and “Pillars of Iraqi Financial Reform” but what does all this really mean? Yes, a nice sounding plan but without the political clout both inside and outside Iraq to allow them to have them the end result (reinstatement) it will get them nowhere in a hurry.

So, this effort if on God’s mind too.

Brilliant Iraqi economist who served as the governor of the Central Bank of Iraq from September 2003 to October 2012.

For many Iraqis, the news of Dr. Sinan al-Shabibi’s unfortunate passing on Saturday, Jan. 8, 2022 could not have come on a worse time. While the loss of one of Iraq’s last firmly independent voices, a respected economist and former central bank governor and someone who genuinely sought the country’s economic transformation, was ominous, in time the day may also become auspicious if his memory and legacy help to inspire a new generation of Iraqis to realize his aspirations for the country. But I will add his brilliant plan to reinstate the Iraqi dinar is not all for nothing. It lives today and is moving forward. It will not die!

You must be logged in to post a comment.